U.S. Large-Scale Battery Storage Power Capacity Increased 35% In 2020

August 17, 2021

by Paul Ciampoli

APPA News Director

August 17, 2021

The U.S. continued a trend of significant growth in large-scale battery capacity, with U.S. battery power capacity reaching 1,650 megawatts (MW) by the end of 2020, the U.S. Energy Information Administration (EIA) reported on Aug. 16.

According to EIA’s report, Battery Storage in the United States: An Update on Market Trends, U.S. battery power capacity grew by 35% in 2020 and has tripled in the last five years.

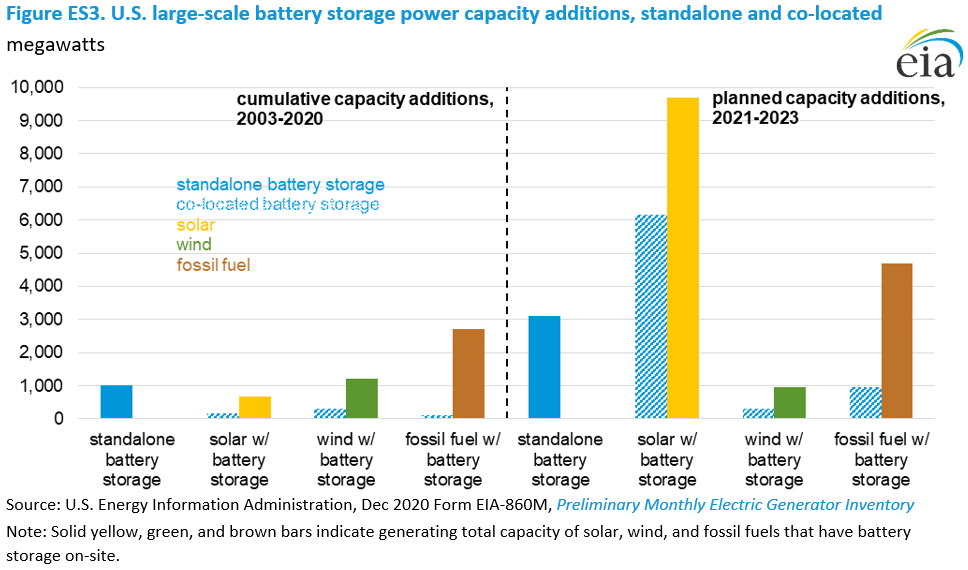

EIA expects that most large-scale battery energy storage systems to come online over the next three years will be built at power plants that also produce electricity from solar photovoltaics, a change in trend from recent years.

As of December 2020, the majority of U.S. large-scale battery storage systems were built as standalone facilities. Only 38% of the total capacity to generate power from large-scale battery storage sites was co-located with other generators: 30% was co-located specifically with generation from renewable resources, such as wind or solar PV, and 8% was co-located with fossil fuel generators.

“We expect the relationship between solar energy and battery storage to change in the United States over the next three years because most planned upcoming projects will be co-located with generation, in particular with solar facilities,” EIA said in the report.

If all currently announced projects from 2021 to 2023 become operational, then the share of U.S. battery storage that is co-located with generation would increase from 30% to 60%.

Based on planning data collected by EIA, an additional 10,000 MW of large-scale battery storage’s ability to contribute electricity to the grid is likely to be installed between 2021 and 2023 in the United States, which is10 times the total amount of maximum generation capacity by all systems in 2019.

Almost one-third of U.S. large-scale battery storage additions will come from states outside of the PJM Interconnection and the California ISO, which led in initial development of large-scale battery capacity.

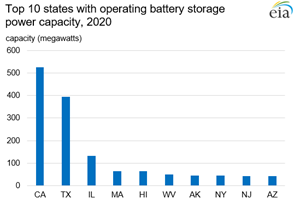

Five states account for more than 70% of U.S. battery storage power capacity as of December 2020, with California alone accounting for 31% of the U.S. total (506 MW). Texas, Illinois, Massachusetts, and Hawaii each have more than 50 MW of power capacity.

More than 400 MW of small-scale total battery storage power capacity also existed in the United States as of 2019, with California accounting for 83% of the capacity. Small-scale batteries have a nameplate power capacity of 1 MW or less.

U.S. battery system energy capacity also continued to increase, reaching 1,688 megawatt hours at the end of 2019, a 30% increase from 2018.

The entire report is available on the EIA website.

Installed Power Capacity Of Large-Scale Battery Storage In U.S. Continued To Grow: EIA

August 3, 2021

by Paul Ciampoli

APPA News Director

August 3, 2021

Installed nameplate power capacity of U.S. large-scale battery storage reached 1,650 megawatts (MW) by the end of 2020, the U.S. Energy Information Administration (EIA) reported on July 26.

The 2020 figure represents a 35% (or 428 MW) increase compared with installed battery storage capacity at the end of 2019 (1,222 MW), EIA said in its Electricity Monthly Update.

EIA defines large-scale capacity as those systems with a nameplate capacity of 1 MW or greater. Although the first battery storage system reported to us as of December 2020 began operation in 2003, cumulative battery storage did not surpass 100 MW until 2012, it said.

The federal agency noted that significant battery storage growth began in 2015 when 153 MW of annual operational capacity were added, a 90% increase relative to 2014 levels. Following that growth, battery storage surpassed the 1 gigawatt (GW) mark in 2018.

“As currently reported to us, cumulative planned battery storage power capacity additions for 2021 through 2024 equal 10,904 MW (or 10.9 GW). If all of these projects come online and if no current operating capacity is retired, battery storage power capacity could exceed 12 GW by 2024,” EIA said.

EIA said that battery storage systems are being installed tor a number of reasons including:

- Balancing grid supply and demand

- Reserving energy for times of high demand (referred to as peak shaving)

- Storing energy from intermittent renewable sources, such as wind and solar, to dispatch at a later time

- Providing fast response ancillary services, such as frequency regulation

- Creating opportunities to take advantage of price arbitrage

According to EIA, the most recent increase in new storage capacity is mainly due to the installation of battery energy systems connected to solar projects.

The federal agency reported that the 1,650 MW of operating battery storage power capacity at the end of 2020 were spread out across 33 states, although more than 70% were in 5 states: California, Texas, Illinois, Massachusetts, and Hawaii. Each of these states have over 50 MW of battery storage power capacity. California has the most with 506 MW of battery storage power capacity. Each of these five states have passed legislation in recent years, either to establish requirements for energy storage or to provide financial incentives for new projects, EIA noted.

The 10,904 MW of planned battery storage power capacity additions through the end of 2024 are spread out across 22 states, although over 70% were in 4 states: California, Texas, New York, and Arizona.

California has more than 4 GW of battery storage power capacity planned by 2024, Texas and New York are planning to install over 1 GW each, and Arizona plans to install just under 1 GW.

EIA said that the top 10 states for planned battery storage capacity additions (including Nevada, Florida, New Mexico, Hawaii, Colorado, and Massachusetts) account for 94% of planned additions, or 10.5 GW, by 2024.

EIA said that the concentration of new battery storage capacity additions in the top 10 states may be partly due to one or more of the following factors:

- A high renewable resource base where storage can partner with, or be situated near, projects to take advantage of that resource (for example, very windy or sunny locations)

- State policies that encourage renewable and battery systems

- The presence of local, real-time, capacity-constrained markets that may present economic opportunities for battery storage systems

EIA noted that it will soon publish an update to the report U.S. Battery Storage Market Trends. This report provides further information about battery storage projects including geographic representation, ownership, chemistry, applications, costs, and future trends.

The American Public Power Association’s Public Power Energy Storage Tracker is a resource for association members that summarizes energy storage projects undertaken by members that are currently online.

Growth of solar-plus-storage not fully explained by economics: Berkeley Lab report

July 27, 2021

by Peter Maloney

APPA News

July 27, 2021

The pairing of photovoltaic (PV) solar power with battery storage is growing but represents a small portion of the market and cannot be fully explained by economics, according to a new report from the Lawrence Berkeley National Laboratory (LBNL).

The report, Behind-the-Meter Solar+Storage: Market Data and Trends, found that out of the 3,200 megawatts (MW) of battery storage installed in the United States through 2020 about 1,000 MW, or 30 percent, was behind-the-meter and 550 MW of that was paired with solar power. The overwhelming majority, 80 percent, of the combined solar and storage installations were in the residential sector.

Most non-residential energy storage installations were done on a stand alone basis with only about 40 percent paired with solar power. In the utility scale, front-of-the-meter market segment, only 420 MW, or 19 percent, of storage capacity was paired with solar power.

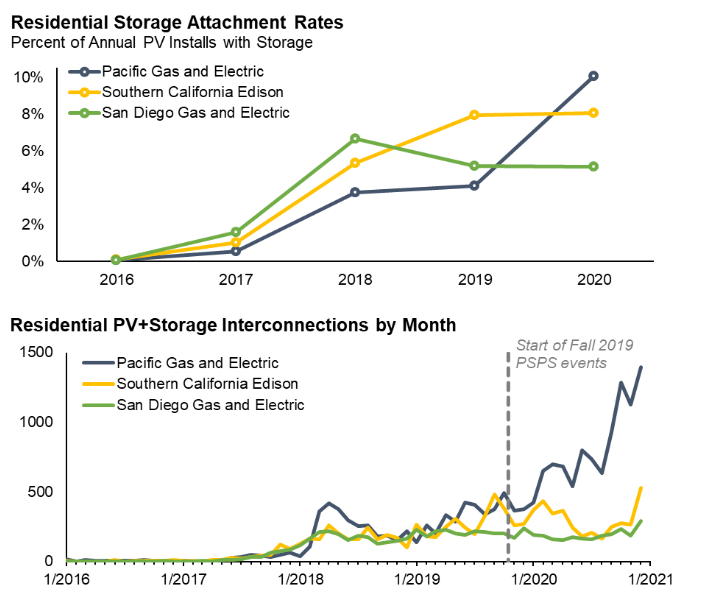

Of all the residential photovoltaic solar systems installed in 2020, about 6 percent included storage and only 2 percent of non-residential solar systems included storage, but there were wide variations in the numbers depending on location, the report found.

Hawaii has, by far, the highest storage attachment rates of any state with 80 percent of residential and 40 percent of non-residential solar systems including storage in 2020. That market, the report says, is driven by net metering reforms that incentivize self-consumption instead of utility payments for excess solar generation.

California was a distant second with 8 percent of residential and 2 percent of non-residential solar systems attaching storage in 2020, driven mostly by incentives and wildfire resilience issues, the report found.

While attachment rates are generally lower outside of California and Hawaii, some utilities, such as Salt River Project in Arizona and Puget Sound Energy in Washington, have attachment rates in the 10 to 20 percent range. In general, however, the report found that residential attachment rates have been rising while non-residential trends are uneven, but in aggregate have been “fairly flat.”

The report also found that residential adopters of solar-plus-storage systems generally have higher incomes than stand-alone PV solar adopters. In California, for instance, solar-plus-storage adopters had median incomes 66 percent higher than their area median income, while stand-alone solar adopter incomes were 41 percent higher.

Within the non-residential sector, for-profit commercial entities comprise about 70 percent of all paired non-residential systems. Schools make up a notably larger share, 25 percent, of paired solar-plus-storage systems than they do for stand-alone solar systems (8%), reflecting “a unique resilience value and relatively large loads,” the report said.

The report also used three different data sources to look at the cost of adding storage to a solar installation and found an incremental cost of adding storage to a residential PV solar system to be about $1,000 per kilowatt hour (kWh) of storage, implying an installed price premium of about $1.20 per watt of solar PV.

In addition to finding that the deployment of solar-plus-storage is locationally specific and driven by rate structures, incentive programs, and natural disaster threats, the report concluded that installed prices for behind-the-meter battery systems have generally risen or remained flat over the past few years. Increasing adoption of battery storage systems cannot, therefore, be attributed to falling retail costs alone, the authors said.

“Deployment trends partly reflect the underlying economics, but there are also some apparent disconnects,” The report’s authors said. Among the disconnects, they noted lower attachment rates in the non-residential sector than in the residential sector, divergent attachment rates across regions with similar payback, and uneconomic adoption in some markets. “Those apparent disconnects may partly reflect other sources of value beyond the direct financial benefits—including potential customer reliability benefits from backup power during outages,” the authors concluded.

San Francisco Public Utilities Commission seeks renewable energy, storage proposals

July 21, 2021

by Paul Ciampoli

APPA News Director

July 21, 2021

The San Francisco Public Utilities Commission (SFPUC) is accepting bids for renewable energy supplies and stand-alone energy storage for its CleanPowerSF program, SFPUC said on July 19.

The request for offers (RFO) seeks bids of energy, environmental attributes, capacity attributes, ancillary services and related products from new and existing eligible Renewable Energy Resources (ERRs), co-located ERR and energy storage resources and stand-alone energy storage resources.

Through the RFO, the SFPUC seeks bids for various energy supply product types.

Bids submitted for the respective product types must meet the following criteria:

- ERRs and energy storage resources must be directly connected to the California Independent System Operator Balancing Authority Area, with a preference for resources located in the nine Bay Area counties;

- For ERRs, minimum annual energy delivery of 10,000 megawatt-hours (MWh) per year and a maximum of 200,000 MWh per year;

- Energy storage resources must provide resource adequacy capacity and be at least 1 megawatt AC for at least 4-hour duration;

- Initial delivery date ranging from January 2022-December 2026;

- For ERRs and ERRs co-located with energy storage resources, terms up to 25 years; and

- For stand-alone energy storage resources, terms up to 15 years

A program of the SFPUC, CleanPowerSF is San Francisco’s Community Choice Aggregation program.

The RFO is available here.

Department of Energy Sets Goal To Cut Cost Of Grid-Scale, Long Duration Storage By 90%

July 14, 2021

by Paul Ciampoli

APPA News Director

July 14, 2021

U.S. Secretary of Energy Jennifer Granholm on July 14 announced the U.S. Department of Energy (DOE)’s new goal to reduce the cost of grid-scale, long duration energy storage by 90% within the decade.

Long duration energy storage is defined as systems that can store energy for more than 10 hours at a time.

This marks the second target within DOE’s Energy Earthshot Initiative, which aims to accelerate breakthroughs of more abundant, affordable, and reliable clean energy solutions within the decade. Under the first Eearthshot Initiative, DOE launched an effort to reduce the cost of clean hydrogen by 80% to $1 per kilogram in one decade.

The Long Duration Storage Shot will consider all types of technologies, whether electrochemical, mechanical, thermal, chemical carriers, or any combination that has the potential to meet the necessary duration and cost targets for grid flexibility.

Currently, pumped-storage hydropower is the largest source of long duration energy storage on the grid, and lithium ion is the primary source of new energy storage technology deployed on the grid in the United States, providing shorter duration storage capabilities, DOE noted.

DOE said it developed the Long Duration Storage Shot target through its Energy Storage Grand Challenge (ESGC) and stakeholder engagement activities and input from subject matter experts, and will continue concerted outreach to advance the Long Duration Storage Shot and ESGC’s aggressive goals and strategy.

ESGC and the Long Duration Shortage Shot are linked with integrated efforts across the Department’s Offices of Energy Efficiency and Renewable Energy, Electricity, Fossil Energy and Carbon Management, Science, Nuclear Energy, and Technology Transitions, as well as the Advanced Research Projects Agency – Energy.

NREL report sees energy storage capacity increasing fivefold by 2050

June 13, 2021

by Peter Maloney

APPA News

June 13, 2021

Long duration, utility-scale energy storage could grow to 125 gigawatts (GW) by 2050, a fivefold increase, according to a new report from the National Renewable Energy Laboratory (NREL).

There are currently about 23 GW of energy storage installed in the United States, almost all of which is pumped hydropower and is assumed to have a duration of up to 12 hours, NREL said.

The report, Economic Potential of Diurnal Storage in the U.S. Power Sector, found that diurnal storage, that is, storage with durations of up to 12 hours, is “extremely competitive on an economic basis.”

There is “significant market potential for diurnal energy storage across a variety of scenarios using different cost and performance assumptions for storage, wind, solar photovoltaics (PV), and natural gas,” the report’s authors wrote.

Across all scenarios, deployment for energy storage exceeds 125 GW by 2050 but, depending on cost trajectories and other variables, could go as high as 680 GW, “indicating a rapidly expanding opportunity for diurnal storage in the power sector,” the report found.

Initially, new energy storage installations will be mostly resources with shorter durations, up to four hours, but then will progress to durations of up to 12 hours as technology costs decrease and renewable resource penetration increases, the report said.

The report’s models project that annual deployment of battery storage will range from 1 GW to 30 GW by 2030 and by 2050 will range from 7 GW to 77 GW.

“These are game-changing numbers,” Will Frazier, NREL analyst and lead author of the report, said in a statement.

To assess the viability of long duration storage, the researchers added new capabilities to NREL’s Regional Energy Deployment System (ReEDS) capacity expansion model to represent the value of diurnal battery energy storage when it is allowed to provide grid services. The cost and performance metrics focused on lithium ion batteries because the technology has more market maturity than other emerging technologies.

The report found that economic storage deployment is driven primarily by the combination of capacity value and energy arbitrage, or time-shifting, value. “The combination of these value streams is needed for optimal storage deployment to be realized,” the authors said.

The report also reaffirmed the strong correlation found between solar PV penetration and energy storage market potential. More PV generation “leads to narrow net-load peaks in the evenings which increases the market potential of storage capacity value. More generation from PV also creates more volatile energy price profiles which increases the market potential of storage energy time-shifting value,” according to the report.

Across the report’s cost-driven scenarios, variable renewable energy reaches penetrations of 43 percent to 81 percent but does not achieve the deployment needed to meet deep decarbonization goals, the authors said. “Future work will consider scenarios with an accelerated transition to a clean energy grid by 2035 and the resulting impact on storage deployment,” they said.

The next report in NREL’s Storage Futures Study series will assess customer adoption potential of distributed diurnal storage for several future scenarios and look at the larger impacts of storage deployment on power system evolution and operations.

BPA, WAPA and Trinity Public Utilities District take steps to help mitigate wildfire threat

June 9, 2021

by Paul Ciampoli

APPA News Director

June 9, 2021

According to Wood Mackenzie and the U.S. Energy Storage Association’s (ESA) latest U.S. Energy Storage Monitor report, 910 megawatt-hours (MWh) of new energy storage systems were brought online in the first quarter of 2021, an increase of 252% over the first quarter of last year, making it the biggest first quarter so far for the U.S. storage market.

After a record-setting quarter for deployments in the final quarter of 2020, the pace of storage deployments slowed in the first quarter, but despite the dip this quarter, the storage market still notched its third-highest megawatt total for one quarter.

Looking ahead to the rest of 2021, deployments are expected to accelerate dramatically, according to the report. Wood Mackenzie, a research and consulting group, forecasts that nearly 12,000 MWh of new storage will be added in 2021, which is three times the amount of new storage added in 2020.

Wood Mackenzie and the ESA said that one of the most significant storage market developments in the first quarter was the introduction of a stand-alone storage investment tax credit (ITC) in Congress. If passed this year, a stand-alone storage ITC would result in a 20-25% upgrade to Wood Mackenzie’s five-year market outlook in megawatt terms.

“An extra 20 to 25% growth for the US market over the next five years would supercharge an already fast-growing energy storage market,” said Chloe Holden, Wood Mackenzie Energy Storage Analyst, in a statement. “The front-of-the-meter (FTM) segment would see the largest incremental growth, with an extra 6 GW of capacity expected through 2025, which is 25% of our base case market forecast. Without the stand-alone storage ITC, we forecast that the FTM segment will add 3,674 MW in 2021 and 6,915 MW in 2026.”

As noted in the report, the U.S. residential storage market set yet another quarterly record in the first quarter of 2021. The market has grown for nine quarters in a row and broke 100 MW deployed in a single quarter for the first time in the first quarter.

Holden said that backup power to complement rooftop solar systems has become the key selling point for residential battery systems in all U.S. markets. Although other states also have growing markets, California will continue to lead the residential segment by a significant margin through 2026, she said.

The non-residential market (commercial and community-scale) is not seeing the same growth as other sectors, with between 25 and 35 MW of new projects installed in each of the last five quarters.

The report also notes that the FTM interconnection queue now sits at over 200 gigawatts.

NYPA, EPRI awarded $200,000 to research long-duration storage

June 9, 2021

by Paul Ciampoli

APPA News Director

June 9, 2021

The New York Power Authority (NYPA) is launching a project with the Electric Power Research Institute (EPRI) to explore the use of crushed rock thermal energy storage to provide energy storage in a market with significant renewable energy resources.

The project, led by EPRI and funded by a $200,000 U.S. Department of Energy grant, will investigate the feasibility of a thermal energy storage (TES) technology developed by Brenmiller Energy. Another $50,000 will be funded by the project participants.

If determined to be feasible, the investigation team will pilot the technology and evaluate its ability to provide energy storage at NYPA’s Eugene W. Zeltmann Power Project in Astoria, N.Y.

Brenmiller, an Israeli developer and manufacturer of thermal energy storage systems, has patented a high-temperature crushed-rock TES system, which is being tested in three generations of demonstration units at separate sites globally.

The first phase of the project will be a feasibility study on the integration of the crushed-rock thermal energy storage into a range of fossil generation assets, which is expected to be complete in early 2022.

A project plan would be developed for a second phase that would evaluate real world operating conditions and demonstrate the technology’s ability to provide effective and economical energy storage at a natural gas combined cycle plant.

The plan is to evaluate the cost and performance of Brenmiller’s TES technology, to support commercial-scale deployment by 2030.

As part of its Vision2030 strategic plan, NYPA is investigating the potential for low- to zero-carbon technologies at several of its facilities to help transition New York State from fossil fuel generation and stabilize the grid as it integrates cleaner sources of energy.

NYPA is also partnering with Brenmiller on a separate project to develop and demonstrate a TES-based combined heat and power (CHP) system at Purchase College (State University of New York) in Harrison, N.Y., to increase energy efficiency and reduce greenhouse gas emissions. That unit is expected to be operational later in the summer of 2021.

Additional information about Brenmiller is available here.

Artificial intelligence project looks to improve energy storage dispatch

June 8, 2021

by Peter Maloney

APPA News

June 8, 2021

Independent power producer Vistra is using artificial intelligence (AI) software developed by a team at the University of Texas at Dallas (UT Dallas) to help it better predict wholesale power market prices in California.

Vistra is using the software to project electricity prices for its soon-to-be 400-megawatt (MW) Moss Landing energy storage facility in Monterey County, Calif.

Vistra’s Moss Landing project is one of four energy storage projects awarded power purchase agreements with Pacific Gas and Electric in 2018 through a solicitation designed to find alternatives to renewing reliability-must-run contracts for gas-fired projects owned by Calpine that serve the South Bay area in California.

The software was developed by researchers from the University of Texas at Dallas who applied statistical and machine-learning methods to build models that Vistra is now using to predict near real-time bid and sell prices in California’s wholesale power market to enable it to buy electricity to charge the Moss Landing batteries at the lowest price and sell the stored energy at the most economically opportune time.

The joint project, which was funded by Vistra, was “crucial to optimizing electricity pricing at the Moss Landing battery farm that came online in early 2021, Rachit Gupta, vice president at Vistra and lead sponsor of the project, said in a statement. “The project was a tremendous success, and we are extremely happy that we availed ourselves of a great source of expertise that is present locally.” The software helps Irving, Texas, based Vistra make more precise pricing projections, Gupta said.

Its work for Vistra was the inaugural project for the Center for Applied AI and Machine Learning (CAIML) at UT Dallas’ Erik Jonsson School of Engineering and Computer Science. The center was established in 2019 to work with industry partners to apply advanced research in AI and machine learning to solve practical problems.

The UT Dallas researchers completed work on the AI project in August 2020 and held classes from December through February to train Vistra employees in the background technologies.

“AI can help a company like Vistra forecast future generation and demand on load, wind and solar energy, and optimize bidding, scheduling and deployment of energy to improve profitability and market participation,” Feng Chen, associate professor of computer science at UT Dallas and the project’s principal investigator, said in a statement.

Power sector increasingly looking at AI

The electric power industry is increasingly looking at AI for ways to solve difficult problems or improve the performance of complex systems. In March, the Electric Power Research Institute (EPRI) held a roundtable on AI in the power sector.

The roundtable was one of several EPRI hosted in its effort to foster collaboration between the power and AI industries through its AI.EPRI project.

Public power utilities, such as CPS Energy, are among the utilities exploring the uses of AI and machine learning. The San Antonio, Texas, utility is machine learning to improve its demand management and is starting to use the technology to improve its vegetation management programs.

In 2019, Salt River Project in Arizona signed a deal to use AI to improve its information technology operations. And in New York, the New York Power Authority (NYPA) is working with software vendor C3 IoT to use AI to help meet its energy efficiency targets.

In April, APPA received its third patent related to its efforts to help ensure that public power utilities have long-term access to advanced analytical technologies for business-related decision making.

New software tool helps utilities, customers evaluate energy storage

May 25, 2021

by Peter Maloney

APPA News

May 25, 2021

Sandia National Laboratories has released a software tool designed to help utilities and utility customers assess the economic value of installing an energy storage system.

The software suite, known as Quest, currently has two principal tools: a behind-the-meter tool for businesses or organizations such as schools and hospitals and a market-analysis tool to help utilities assess how much revenue an energy storage system would generate.

The open source software is available for download on the Quest page of Sandia’s website.

The behind-the-meter tool allows business owners or city project managers to estimate how much money an energy storage system could save them when combined with solar panels or other power generation sources.

To use the behind-the-meter tool, a customer inputs their location and the rate structure they pay to determine if a storage system could save them money by shifting their energy use away from peak times when rates are high. The software can be adjusted to reflect the kind of renewable power system the customer has or would like to install.

“For example, a homeowner or a warehouse manager who knows nothing about energy storage but wants to install it for their rooftop solar panels, can use Quest’s streamlined process to learn how much money the energy storage system would save them over a year,” Tu Nguyen, a Sandia electrical engineer who led the development of the optimization algorithms underpinning Quest, said in a statement.

The market-analysis tool is designed to allow small utilities determine how much revenue an energy storage system could generate by providing services to enhance grid stability and reliability. The tool uses historical data for the seven energy markets in North America, including the Electric Reliability Council of Texas (ERCOT) and the California Independent System Operator (CAISO).

“We’re providing an easy-to-use, open-source software suite that people can use to do their own energy storage analysis,” Babu Chalamala, manager of Sandia’s energy storage research program, said in a statement. “They could be small utilities or co-ops, vertically integrated utility companies or a project developer who wants to use energy storage.” The software can be used to evaluate the needs of a particular project and to determine if energy storage make sense and to provide a cost-benefit analysis, he said.

Sandia says Quest can also be used by energy researchers to evaluate different energy storage scenarios and model the potential of new solutions. “In our cutting-edge storage installations, we start by modeling the business case with Quest,” Imre Gyuk, who directs the energy storage program at the Department of Energy’s Office of Electricity, said in a statement. “If the results look promising to us and our project partners, we go ahead with the venture. After completion, we monitor the system using Quest for guidance and to optimize benefits.”

“Quest is a useful application suite for a lot of utilities, a kind of tool that isn’t really available commercially,” Chalamala said. The application’s “foundational capabilities” can set the stage for further development of any other applications people need to develop, he said.

The Sandia team that developed Quest is also working with PNM, New Mexico’s largest electricity provider, to develop a tool to help vertically integrated utilities assess the different paths for achieving reliable 100% carbon-free electricity by 2045.

The Quest team is also investigating the costs and benefits of adding energy storage to the New Mexico grid in comparison with transmission-infrastructure expansion to better transport power from renewable energy power plants to cities. When the new tools have been developed and tested, they will be added to Quest for any utility or researcher to use.

Another tool the Quest team is working on would help evaluate resilient microgrids and would help consumers compare different kinds of energy storage technologies depending on their locations and applications. The team is also working on a cost-analysis tool and a tool for comparing different battery technologies as they age.

Longer term, Sandia would like to include a distribution-modeling tool to quantify how energy storage can help increase the amount of solar power the grid can safely handle before the control systems need to be upgraded.

Sandia National Laboratories is operated and managed by National Technology and Engineering Solutions of Sandia, LLC., a wholly owned subsidiary of Honeywell International, Inc.

National Technology and Engineering Solutions of Sandia operates Sandia National Laboratories as a contractor for the U.S. Department of Energy’s National Nuclear Security Administration (NNSA) and supports numerous federal, state, and local government agencies, companies, and organizations.