Ormat Solicitation Seeks Buyers For Output Of 26-MW, California Geothermal Plant

July 29, 2021

by Peter Maloney

APPA News

July 29, 2021

Ormat Nevada is seeking bids for the purchase of capacity and energy from its repowered 26 megawatt (MW) Heber 2 geothermal project in Heber, Calif.

The winning bidder will receive all available environmental attributes and capacity rights and energy output associated with the geothermal plant as a bundled product that qualifies under California rules for in-state bundled renewable energy credits.

The plant has a 95 percent capacity factor and an existing on-site interconnection within the Imperial Irrigation District’s 92 kilovolt (kV) system and firm transmission service rights to deliver energy at the California Independent System Operator (CAISO) 230-kV Mirage intertie.

Heber 2 is owned and controlled by OrHeber 2 LLC, a subsidiary of Ormat Nevada.

Geothermal energy is well suited to complement intermittent forms of renewable energy such as photovoltaic solar power by supplying energy 24 hours a day regardless of weather conditions, Ormat said. The company noted that, as of June 2021, the California Public Utilities Commission is requiring load serving entities to procure 11,500 MW of new clean electricity by 2026, of which 1,000 MW must be firm power with an 80 percent capacity factor, produces zero on-site emissions, and is weather independent.

The deadline to submit questions regarding the solicitation is Aug. 6. Questions should be addressed to abartosz@ormat.com and will be answered by Aug. 13. Bids are due Aug. 20. Ormat expects to notify the shortlisted buyers by Sept. 10.

The request for bids is available here,

The Heber 2 project is a water-cooled, binary geothermal facility that has been in operation since 1993. It is being repowered to increase its capacity to 26 MW from 12 MW by the replacement of the Ormat Energy Converter units while retaining the existing physical plant footprint. Ormat expects to complete the repowering and have the plant online by Jan. 1, 2023.

The company says the plant will have a 95 percent capacity factor and be able to deliver about 216,000 megawatt hours (MWh) in its first year of operation. Ormat estimates the annual degradation of the facility at 0.05 percent.

Ormat self financed the project and the plant site fully controlled on private land owned by Ormat. The existing facility has all required major permits, and the project has completed a Phase 1 Environmental Site Assessment and has primary local land use permits, Ormat said.

Ormat said preference will be given to bidders who:

- allow for solar power for auxiliary load service, increasing the geothermal output;

- are flexible on the estimated repowering online date;

- offer pricing at P-node or the Mirage 230-kV substation;

- enable Ormat to post a surety for the development and operating securities; and

- are willing to lower the risk of liquidated damages for delays on achieving development period minimums.

A recent report from the National Renewable Energy Laboratory outlined the potential of geothermal energy and the impediments for its deployment.

Two California Community Choice Aggregators Contract For Renewable Energy, Energy Storage

July 23, 2021

by Paul Ciampoli

APPA News Director

July 23, 2021

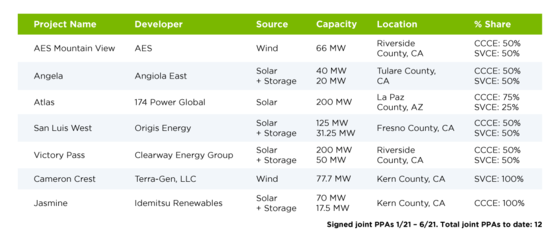

Central Coast Community Energy (CCCE) and Silicon Valley Clean Energy (SVCE) have executed seven power purchase agreements, equating to 778 megawatts (MW) of energy generation between the two community choice aggregators (CCA). The long-term contracts are a result of a request for offers (RFO) jointly issued by the CCAs in 2019 and 2020.

The joint contracts include one wind, one solar, and three solar-plus-storage projects. The solar and solar-plus-storage projects are new builds and will add new generation capacity to the California grid on behalf of the CCAs’ combined 670,000 customers.

In addition to the joint procurement effort, the two agencies signed individual contracts for two separate projects. CCCE signed a power purchase agreement with Idemitsu Renewables for 70 MW of solar and 17.5 MW of battery storage from the Jasmine project in Kern County, Calif., and SVCE signed a contract with Terra-Gen LLC. to receive 77.7 MW of wind energy from three existing wind facilities in Kern County, Calif.

The joint procurement efforts have offered multiple benefits, including shared risk mitigation and greater negotiating power resulting in cost savings that are ultimately passed onto customers. CCCE and SVCE have signed 12 power contracts together, for a total of 1,470 MW and $2.77 billion committed.

Additionally, the newly contracted solar-plus-storage projects are all new facilities and will help meet California’s recent order to build at least 11.5 gigawatts of new resources by 2026. These new resources are needed to integrate existing renewables, ensure reliability, and replace retiring capacity from the Diablo Canyon Nuclear Power Plant in California, the CCAs said.

CCCE and SVCE are also part of a joint effort to procure 500 MW of long-duration storage with seven other CCAs.

The American Public Power Association has initiated a new category of membership for community choice aggregation programs.

Rep. DeGette Details Net-Zero Emissions Bill That Includes Elements Supported By APPA

July 20, 2021

by Paul Ciampoli

APPA News Director

July 20, 2021

Rep. Diana DeGette, D-Colo., recently detailed legislation intended to drive the innovation of new technologies that she said will be needed to reduce U.S. power sector emissions to net zero. The bill incorporates several suggestions made by the American Public Power Association (APPA) and its members.

DeGette offered details on the Clean Energy Innovation and Deployment Act in remarks made at APPA’s National Conference Virtual Event on July 14, 2021.

The legislation is comprised of five parts.

The first part focuses on clean energy innovation and uses a range of measures to “bring the many promising clean energy technologies that we have out there to the point of commercial availability as soon as possible,” DeGette told APPA National Conference Virtual Event attendees.

The second part of the bill creates tax incentives for entities that install zero emission electricity generation. Included in this section of the bill are provisions that give extra incentives to companies that deploy the technology sooner and that deploy them in parts of the country where they’ll have the greatest impact, she said. These tax incentives would be available as direct payments including to public power utilities, DeGette said.

The third part of the bill seeks to protect low-income ratepayers by reauthorizing the Low Income Home Energy Assistance Program (LIHEAP) and increasing funding for the weatherization assistance program.

The fourth section “is designed to provide support to the workers who would be displaced by the shift in energy policy,” DeGette said.

The fifth section of the bill would create the nation’s first federal clean energy standard — a zero-emission electricity standard — which is intended to be completely technology neutral. “This technology neutral approach is one of the reasons why this bill is so unique. By taking such an approach we’re able to prioritize climate action rather than any particular electricity generating technology,” DeGette said.

Under the bill, credits for zero emission electricity generation would be issued by the Environmental Protection Agency (EPA) to generators that would in turn sell the credits to retail electricity suppliers. Those suppliers would then submit the credits back to the EPA.

The bill does not place limits on which generators a retail electricity supplier can get credits from. She noted for example that a public power utility in Missouri could buy credits from a generator in Hawaii “or wherever you can get them for the cheapest price.”

DeGette said that creating a national marketplace for credits like this “will help drive down the price and the overall cost of the program and it also helps fuel competition by investors and inventors who will then have an incentive to develop and implement the most cost effective clean energy technology possible.”

In crafting the bill, the lawmaker recognized the fact that many public power utilities don’t have environmental compliance programs, DeGette said. Therefore, she included a provision in the bill that allows a public power utility to enter into an agreement with any generator to manage the credit submission requirements for them.

“Another key part of the bill is the mechanism that’s put in place to automatically tie the nationwide clean energy standard to the availability of new technologies,” DeGette said. “Under the standard, for example, if we still haven’t developed the technology needed to generate affordable, reliable one hundred percent zero emission electricity by 2050, the bill will use offsets to ensure that we’re still able to achieve net zero emissions.”

On the other hand, “if future technological breakthroughs make it possible for us to move much faster and at a lower cost than we think possible today, the requirements that will be put in place under the bill will also advance, moving the target date to achieve nationwide, one hundred percent zero emission electricity up to and as soon as 2030.”

In order to further protect public power utilities and their customers from a high cost of compliance, “we went a step further when we drafted the bill and added three separate off ramps – one that puts a cap on the cost of credits, a second that provides you an exemption if the required technology isn’t available and a third that provides an exemption for generating electricity from a unit that’s deemed essential for maintaining reliability,” she said.

DeGette serves on two committees — the House Committee on Energy and Commerce and the House Committee on Natural Resources. She also serves on several subcommittees and is chair of the Oversight and Investigations panel of the House Committee on Energy and Commerce.

Geothermal Market Potential And Impediments Outlined In NREL Report

July 20, 2021

by Peter Maloney

APPA News

July 20, 2021

There is the potential for as much as 60 gigawatts (GW) of geothermal capacity in the United States by 2050, but several impediments would first have to be addressed, according to a new report by the National Renewable Energy Laboratory (NREL).

Improvements in regulatory processes and technology advances would be key to facilitating the expansion of geothermal resources, both as a form of primary electricity generation and as a source of district heating, the report, 2021 U.S. Geothermal Power Production and District Heating Market Report, said.

In geothermal power’s favor are several “non-cost factors,” such as the ability of geothermal plants to operate 24 hours a day regardless of weather and without voltage swings, making them an appropriate baseload replacement for retiring fossil fuel plants and a complement for variable energy resources. Those advantages could become increasingly important as states adopt or move closer to mandates requiring low or no carbon dioxide emissions from the power sector, the report said.

The bulk of the 60 GW of geothermal capacity, which NREL references from the Department of Energy’s 2019 GeoVision 2019 study, would be the result of technology advances and cost reductions in the deployment of geothermal resources. The study GeoVision study estimates that about 13 GW of the potential 60 GW could come from improvements in the regulatory process.

One example cited in the NREL report is the lack of risk mitigation schemes and federal and state incentives for geothermal district heating.

NREL also noted that geothermal power production is “likely hindered” by its least cost of energy (LCOE), which, although lower than coal and gas peaking plants, is higher than solar and wind power and combined-cycle gas-fired plants.

In recent years, the U.S. geothermal power sector has seen little capacity growth, NREL said. The sector went from 3,627 megawatts (MW) to 3,673 MW from 2015 to 2019. The 186 MW of new capacity that came online in the time frame were mostly expansions and repowerings of existing plants and was offset by the retirement of 11 plants with a combined capacity of 103 MW.

However, since 2019, nine new geothermal power purchase agreements have been signed in four states, including plans for the first two geothermal power plants to be built in California in a decade, NREL noted.

“The newest market report conveys that the geothermal industry is poised to make big leaps into enhanced geothermal systems and the heating and cooling sector,” Kelly Speakes-Backman, acting assistant secretary for energy efficiency and renewable energy at the Department of Energy, said in a statement. “These strides outline the potential for the widespread deployment of this important renewable resource.”

Speakes-Backman was a recent guest on the American Public Power Association’s Public Power Now podcast.

NPPD Reports Strong Response To Renewable Energy Request For Proposals

July 9, 2021

by Paul Ciampoli

APPA News Director

July 9, 2021

There has been a strong response to a request for proposal (RFP) to provide nearly two million megawatt hours (MWh) of renewable energy by Nebraska Public Power District (NPPD) to support Monolith Materials for its green hydrogen and carbon black operations in Hallam, Neb., NPPD reported on July 9.

The RFP, which was issued earlier this year, resulted in bids for wind, solar, and energy storage projects.

In order to facilitate Monolith Materials’ proposed $1 billion expansion of its Olive Creek facility, NPPD and Monolith signed a letter of intent outlining the companies’ intentions to procure enough renewable energy resources to generate two million MWh annually.

The Columbus, Neb.-based utility noted that it is developing a short list of proposals from the bids received. Projects could be located physically within the Southwest Power Pool (SPP) footprint with preference to those projects located within Nebraska.

SPP is a regional transmission organization that oversees the bulk electric grid and wholesale power market in the central United States on behalf of a group of utilities and transmission companies in 17 states.

“The approximately two million megawatt-hours of generation would create a sufficient number of renewable energy certificates to meet 100 percent of Monolith’s average annual energy usage and meet their environmental and sustainability goals,” said NPPD President and CEO Tom Kent. “While we are adding additional generation resources, NPPD will continue to maintain our highly competitive rates, which was one of the reasons Monolith moved its operations to Nebraska. We are very interested in pursuing locations where the local community welcomes these types of investments in wind and solar projects,” he said in a statement.

That short list is expected to be completed later this summer with successful respondents being notified this fall, followed by contract negotiations and eventual board approval. Kent indicated that expectations are that all operations would be in place by Dec. 31, 2025.

A total of 28 different companies provided responses for a mix of wind, solar, storage and clean energy products. This included 21 wind projects totaling nearly 4,000 megawatts, 33 projects for solar amounting to approximately 5,800 megawatts, and electric storage projects amounting to 2,200 megawatts.

The majority of proposals provided locations within Nebraska.

LADWP study will expand its clean energy goals to include social equity

July 7, 2021

by Peter Maloney

APPA News

July 7, 2021

The Los Angeles Department of Water and Power (LADWP) is expanding its 100 percent renewable energy goal to include social equity and greater community input.

LADWP’s board of directors on June 23 authorized the public power utility to move forward with LA100 Equity Strategies, which aims to incorporate community-driven and equitable outcomes into the goals of the LA100 study completed by the National Renewable Energy Laboratory (NREL) in March.

The LA100 study identified multiple paths for LADWP to achieve a 100 percent renewable and carbon dioxide free electric grid by 2045. Since then, LADWP officials and Los Angeles Mayor Eric Garcetti have moved the 100 percent goal forward to 2035 with interim milestones of 80 percent renewable energy and 97 percent carbon dioxide free energy by 2030.

LA100 Equity Strategies grew out of LA100’s finding that all communities will share in the benefits of the clean energy transition but improving equity in participation and outcomes would require intentionally designed policies and programs.

“While LA100 found that we can achieve 100 percent renewable energy and a carbon-free grid, and do so reliably, we recognized the need for legitimate and substantive engagement with our communities and stakeholders if we are to lead the state and nation on decarbonization and create a model that other utilities can replicate,” Cynthia McClain-Hill, president of LADWP’s board, said in a statement. “LA100 Equity Strategies is a critical next step on the path to 100 percent renewables, with the goal of lifting up all Angelenos so that everyone will share in the benefits of clean energy.”

LADWP’s board authorized NREL to lead LA100 Equity Strategies in cooperation with the Luskin Center for Innovation at the University of California, Los Angeles (UCLA).

The equity study will incorporate the analysis and findings of the LA100 study and look for ways to achieve specific outcomes that will be identified through a stakeholder engagement process. “Every neighborhood of Los Angeles is unique, and this will be a neighborhood-level, community-driven process,” McClain-Hill said. “Beginning with the very first stage, LA100 Equity Strategies will bring together environmental justice communities and stakeholders to identify and prioritize what outcomes they would like the study to analyze.”

LADWP’s equity metrics initiative identified disparities in low-income and underserved communities in participation in customer-focused clean energy programs such as customer rooftop solar, electric vehicle and charging station rebates, smart thermostat rebates, and other programs designed to help customers save energy and money.

The study will examine a set of goals that could include:

- Access to energy customer programs and distributed energy resources;

- Local neighborhood power grid upgrades;

- Assistance to renters to participate in solar, energy efficiency, and electrification programs;

- Reduced environmental impacts of end-of-life of technologies, such as batteries;

- Increased public charging to promote access to electric vehicles;

- Improved air quality through renewable-resource derived fuels;

- Affordable rates and utility debt relief;

- Clean air, including for those located near power facilities; and

- Impacts to housing and transportation.

LADWP “must ensure that customers who are impacted by poor air quality and have the least ability to afford higher electric bills are able to benefit from the clean energy transformation,” Martin Adams, LADWP’s general manager and chief engineer, said in a statement.

Adams discussed the LA100 study in a recent episode of the American Public Power Association’s Public Power Now podcast.

Santee Cooper signs contracts for solar power

July 7, 2021

by Peter Maloney

APPA News

July 7, 2021

Santee Cooper, the state-owned public power utility in South Carolina, has signed contracts to take about 27.5 percent of the output of five planned solar power projects in South Carolina totaling 425 megawatts (MW).

Central Electric Power Cooperative, Santee Cooper’s largest customer, has signed contracts to take the remaining share of the output of the solar projects.

Santee Cooper will manage the solar projects as part of its combined power system. As the aggregator for South Carolina’s individual electric cooperatives, Central Electric Power Cooperative represents about 72.5 percent of the system’s load.

The 425 MW of solar power would be equal to nearly 40 percent of the currently installed solar capacity in South Carolina.

The largest of the planned solar installations are two 100-MW projects being built, owned and operated by Silicon Ranch, the solar power platform of Shell. The Lambert I and Lambert II projects are sited in Georgetown County, South Carolina, and are expected online in the fourth quarter of 2023.

Birdseye Renewable Energy, a subsidiary of Dominion Energy, is developing a 75-MW solar farm in Aiken County, also expected online in the fourth quarter of 2023.

Ecoplexus is developing the 75-MW Hemingway project in Williamsburg County that is expected online in the second quarter of 2023.

Johnson Development Associates is developing a 75-MW solar farm near Summerville, in Dorchester County that is expected online in the fourth quarter of 2023.

The four developers were chosen through a request for proposals (RFP) a year ago that was jointly analyzed by Santee Cooper and Central Electric Power Cooperative.

The RFP process yielded 58 project proposals totaling more than 3,600 MW.

Santee Cooper said the recently contracted solar projects represent the first of three phases it is planning as it as it transforms its generating portfolio to a leaner, greener mix. The next phases, of another approximately 500 MW each, are scheduled for later in this decade and in the early years of the next decade.

Work underway to develop a NAESB base contract for voluntary renewable energy certificates

June 17, 2021

by Paul Ciampoli

APPA News Director

June 17, 2021

Wholesale and retail entities have been holding a series of virtual meetings through the North American Energy Standards Board (NAESB) to develop a NAESB base contract for voluntary renewable energy certificates (RECs) and the technical implementation that could lead to the digitization of the contract.

Details of the effort were recently outlined by Elizabeth Mallett, Deputy Director of NAESB, in an Energy Central post and in a Q&A with Public Power Current.

In the May 25 post, Mallett points out that corporations worldwide are increasing their commitments to employ renewable energy in their day-to-day operations by procuring RECs to meet their renewable claims. RECs are market-based instruments that represent the right to one megawatt-hour of renewable generation. RECs are purchased for state renewable portfolio standards to maintain compliance requirements, but there is also a growing market for voluntary RECs that has bloomed over the past decade as corporations strive to demonstrate their claims of renewable electricity usage and meet corporate goals, she noted in her post.

“As this market has grown, the need for standardization has become more apparent, as opportunities to increase efficiency and eliminate redundant terms and processes present appear throughout the industry. For example, standardization decreases the need for administrative staff to learn regional or state-by-state terms and improves the speed of transactions when consumers deal with multiple states or regions,” Mallett said in the post.

May 28 was the deadline to submit early comments regarding the NAESB Draft Base Contract for RECs. After approval of a final draft by the NAESB subcommittee later this year, a subsequent 30-day comment period will be announced.

Mallett told Public Power Current that industry members that suggested the standardization of voluntary RECs provided several reasons, including:

- REC transactions have increased in the recent years and are projected to continue growing

- Processes are not controlled by a single organization or group

- At least eight separate marketplaces/registries for voluntary or state RPS compliance

- Existing registries represent RECs with different data structures

- Utilities may act as their own registrar and may not use the existing markets to track the REC

NAESB REC Contract spurred by recommendation from TVA

The NAESB REC contract was spurred by a recommendation from Tennessee Valley Authority (TVA) that NAESB consider a REC contract for distributed ledger technology, or blockchain technology.

Mallett notes in her post that the proposed development effort is divided into two parts. “First, NAESB considered the development of the contract general terms and conditions. Next, the technical implementation for the contract is under consideration. The participants will identify the data elements and structures needed to execute the contract electronically, including the information needed to develop the terms and conditions for one or more ‘smart contracts’ to be utilized on distributed ledger technology.”

In December 2019, Joint Subcommittees held a kick-off meeting during which participants aimed to first gain consensus on definitions and use cases. Subsequent meetings continued to analyze terms and issues identified through subcommittee conversation, such as tracking through retirement, fundamental requirements of attestation declarations, billing details, etc., Mallett said in her post. “To date, NAESB has hosted nineteen meetings to discuss the NAESB REC Contract and technical implementation and about thirty-seven entities have participated.”

In a June 1 meeting, the participants dived further into the technical implementation, such as common datasets and data dictionaries. “As the technical implementation development proceeds, aspects of the contract may need to be revisited, especially in light of the informal comments received on the contract before the June meeting,” Mallet noted.

NAESB is divided into three quadrants that represent the wholesale and retail gas and electric industries: the Wholesale Electric Quadrant (WEQ), the Wholesale Gas Quadrant (WGQ), and the Retail Gas and Electric Markets Quadrant (RMQ).

The “Joint Subcommittees” refers to the WEQ Business Practices Subcommittee and the RMQ Business Practices Subcommittee — two separate NAESB subcommittees which have been holding joint meetings since December 2019 to draft the NAESB Base Contract for RECs.

Mallett told Public Power Current that during the June 1, 2021 meeting, participants discussed the informal comments received on the draft contract. Informal comments were submitted from Bonneville Power Administration (BPA), J. Weinstein Law and Southern Company. Additionally, work papers from TVA were posted for the meeting. The entirety of the June 1 meeting comprised a review of the informal comments from BPA, she said. These comments suggested modification to the terms and conditions, section number updates, and basic formatting changes.

The Joint Subcommittees held another meeting on June 8, 2021. During this meeting, additional comments were considered and participants continued to discuss the BPA and J. Weinstein informal comments.

“Looking ahead, after the review of informal comments on the draft contract, the subcommittees will focus on the development of technical implementation documents, such as addressing data dictionaries, and data sets for invoicing and other aspects of the transactions to support the contract,” Mallett said. She noted that the technical implementation will be technology neutral, allowing for the use of the contract in its paper form, or electronically — for example, on a distributed ledger, also known as blockchain.

Per the NAESB process, if the subcommittees vote to adopt the NAESB REC Base Contract, then a thirty-day formal comment period will be held to solicit further comments from any interested parties. Next, the RMQ and WEQ Executive Committees will determine whether to adopt, remand, or reject the effort, after reviewing the draft NAESB REC base contract along with any comments received during the thirty-day formal comment period. If approved by the Executive Committees of the RMQ and WEQ, the draft NAESB REC base contract will be posted for ratification by the NAESB WEQ and RMQ membership. Once ratified, it will be made available to the industry.

NAESB is a nonprofit 501(c)(6) standards development organization. NAESB has about 300 member entities whose volunteers develop gas and electric commercial business practice standards to support industry priorities. The NAESB process is accredited by the American National Standards Institute (ANSI) and, therefore, remains an independent body that is open to and inclusive of all interested industry parties.

NAESB follows a balanced voting procedure to reach consensus-based decisions and to maintain a balance of interests within the organization and NAESB has a strict no advocacy policy, Mallett noted.

If ratified by the NAESB membership, NAESB will publish the NAESB REC base contract in the next version of its WEQ and RMQ business practice standards and, as with all NAESB work products, the NAESB REC base contract will be copyrighted, she said.

North Carolina executive order sets target for 8 GW of offshore wind by 2040

June 15, 2021

by Peter Maloney

APPA News

June 15, 2021

Roy Cooper, North Carolina’s Democratic governor, recently issued an executive order highlighting the state’s commitment to offshore wind power and setting a target to procure 8 gigawatts (GW) of offshore wind energy by 2040.

Executive Order No. 218 also establishes an interim offshore wind development target of deploying 2.8 GW of wind energy plants off the North Carolina coast by 2030 and directs the state’s Secretary of Commerce to establish the N.C. Taskforce for Offshore Wind Economic Resource Strategies (TOWERS) to advise on programs and policies to advance offshore wind projects.

The order also directs the state’s Department of Environmental Quality and Department of Military and Veterans Affairs to designate offshore wind coordinators and take steps to support offshore wind and calls for quarterly meetings of the North Carolina Offshore Wind Interagency Workgroup to ensure offshore wind activities are well coordinated among relevant agencies.

In addition to creating economic benefits in the state, the executive order aims to help achieve the North Carolina Clean Energy Plan goal of a 70 percent reduction in power sector greenhouse gas emissions by 2030 and carbon dioxide neutrality by 2050.

Wind power projects off the Atlantic Coast have the potential to create 85,000 jobs and attract $140 billion in capital investment over the next 15 years, according to the executive order.

The executive order follows a bipartisan memorandum of understanding (MOU) among the governors of North Carolina, Maryland and Virginia in October 2020 that created the Southeast and Mid-Atlantic Regional Transformative Partnership for Offshore Wind Energy Resources (SMART-POWER).

The SMART-POWER MOU provides a framework for the three states to promote, develop and expand offshore wind energy and the accompanying industry supply chain and workforce.

Several Mid-Atlantic states have already taken steps to encourage offshore wind development. Connecticut in late 2019, through a competitive solicitation, selected Vineyard Wind to develop 804 megawatts (MW) of offshore wind. Earlier in 2019, Massachusetts approved long-term contracts for 800 MW of offshore wind between Vineyard Wind and investor-owned electric utilities in the state.

In 2018, New Jersey Gov. Phil Murphy signed an executive order directing the state’s Board of Public Utilities to fully implement legislation to begin the process of moving the state toward a goal of having 3,500 MW of offshore wind in place by 2030.

More recently, the Biden administration and California Gov. Gavin Newsom identified regions off the California coast that could support White House’s goal of deploying 30 GW of offshore wind energy by 2030.

And in March, the New York State Public Service Commission, along with the Long Island Power Authority and other stakeholders adopted a plan to build a 7.6-mile transmission line to connect the proposed 132-MW wind farm in offshore New York waters.

Interior to assess renewable energy development on Gulf of Mexico Outer Continental Shelf

June 13, 2021

by Paul Ciampoli

APPA News Director

June 13, 2021

The Department of the Interior on June 8 announced its intent to assess potential opportunities to advance clean energy development on the Gulf of Mexico Outer Continental Shelf (OCS).

The announcement is part of the Biden Administration’s goal to deploy 30 gigawatts (GW) of offshore wind by 2030.

The Bureau of Ocean Energy Management (BOEM), which is part of the Department of the Interior, published a Request for Interest (RFI) in the Federal Register on June 11 to assess interest in potential offshore wind development in the OCS.

The RFI is focused on the Western and Central Planning Areas of the Gulf of Mexico offshore the states of Louisiana, Texas, Mississippi, and Alabama.

Although the primary focus of the RFI is on wind energy development, BOEM is also seeking information on other renewable energy technologies.

To date, BOEM has leased approximately 1.7 million acres in the OCS for offshore wind development and has 17 commercial leases on the Atlantic, from Cape Cod to Cape Hatteras.

The publishing of the RFI opens a 45-day public comment period to solicit indications of competitive interest and additional information on potential environmental consequences and other uses of the proposed area. BOEM will consider data received in response to this RFI to determine next steps in the renewable energy leasing process in the Gulf of Mexico.

As part of this process, BOEM will convene the Gulf of Mexico Intergovernmental Renewable Energy Task Force to help coordinate planning, solicit feedback, and exchange scientific and process information.

BOEM will hold its first task force meeting on June 15. The task force comprises members representing federal, Tribal, state and local governments from Louisiana, Texas, Mississippi and Alabama.

For more information including a map depicting the RFI area, see BOEM’s renewable energy page.