EPA finalizes revisions to the Cross-State Air Pollution Rule Update

March 16, 2021

by Paul Ciampoli

APPA News Director

March 16, 2021

The U.S. Environmental Protection Agency (EPA) on March 15 finalized revisions to the Cross-State Air Pollution Rule (CSAPR) Update to help areas affected by emissions emitted by power plants in other states meet the 2008 national ambient air quality standards (NAAQS) for ground-level ozone.

The rule responds to a September 2019 ruling by the U.S. Court of Appeals for the D.C. Circuit (Wisconsin v. EPA) by addressing the “significant contribution” of pollution from particular upwind states to downwind states under the authority provided in Clean Air Act’s “good neighbor” section 110(a)(2)(D)(i)(I), in order to help downwind states meet and maintain compliance with the 2008 ozone standard.

The EPA proposed the Revised CSAPR Update in October 2020.

Power plants in 12 states

Starting this summer, power plants in 12 states will be required to cut emissions of nitrogen oxides (NOx) by installing, improving or upgrading pollution controls.

EPA estimates that the Revised CSAPR Update will reduce NOx emissions from power plants in 12 states in the eastern United States by 17,000 tons beginning in 2021 compared to projections without the rule.

Due to this rulemaking and other changes already underway in the power sector, ozone season NOx emissions in the 12 states will be nearly 25,000 tons lower in 2021 than in 2019, a reduction of 19 percent, the federal agency said.

The additional emissions reductions are based on both improving the performance or utilization of pollution controls already installed beginning in the 2021 ozone season and installation or upgrade of state-of-the-art NOx combustion controls beginning in the 2022 ozone season.

The EPA said that the reductions in NOx emissions will lead to significant improvements in air quality beginning in the 2021 ozone season, which starts in May.

During warm weather months, NOx emissions from power plants can react in the atmosphere to create ground-level ozone, or smog, the agency noted. These pollutants can travel great distances, often crossing state lines and making it difficult for other states to meet and maintain the air quality standards for ozone that EPA establishes to protect public health.

Projected 2021 emissions from power plants in Illinois, Indiana, Kentucky, Louisiana, Maryland, Michigan, New Jersey, New York, Ohio, Pennsylvania, Virginia, and West Virginia were found to contribute to NOx emission levels that would harm the ability of downwind states to meet or maintain the 2008 ozone NAAQS, according to EPA.

Details on final rule

In a fact sheet related to the final rule, EPA noted that the action fully resolves 21 states’ remaining “good neighbor” obligations under the 2008 ozone NAAQS.

For nine out of the 21 states for which the CSAPR Update was previously found to be only a partial remedy (Alabama, Arkansas, Iowa, Kansas, Mississippi, Missouri, Oklahoma, Texas, and Wisconsin), projected 2021 emissions do not significantly contribute to nonattainment or maintenance problems for the 2008 ozone NAAQS in downwind states.

Thus, no further emission reductions beyond those under the CSAPR Update are required for these states to address interstate air pollution under the 2008 ozone NAAQS, the EPA said.

For the 12 remaining states (Illinois, Indiana, Kentucky, Louisiana, Maryland, Michigan, New Jersey, New York, Ohio, Pennsylvania, Virginia, and West Virginia), projected 2021 emissions were found to contribute at or above a threshold of 1% of the NAAQS (0.75 ppb) to the identified nonattainment and/or maintenance problems in downwind states.

After further analysis of emission-reduction potential, cost-effectiveness of controls, and downwind air quality improvement, EPA determined additional emission reductions relative to the CSAPR Update were necessary from all 12 of these states.

Specifically, emission reductions are required at power plants in these 12 states based on optimization of existing, selective catalytic reduction (SCR) and selective non-catalytic reduction (SNCR) controls beginning in the 2021 ozone season, and installation or upgrade of state-of-the-art NOX combustion controls beginning in the 2022 ozone season.

“EPA is issuing new or amended Federal Implementation Plans (FIPs) for 12 states that revise state mission budgets that reflect these additional emission reductions beginning with the 2021 ozone season,” the agency said.

EPA will also adjust these 12 states’ emission budgets for each ozone season thereafter to incentivize ongoing operation of identified emission controls until such time that air quality projections demonstrate resolution of these states’ linkages to downwind nonattainment and/or maintenance problems for the 2008 ozone NAAQS.

As such, EPA is adjusting emission budgets for each state for each ozone season for 2021 through 2024. Budgets from 2022 to 2024 are updated to account for known future unit retirements as well as construction of new units. Updates to the 2022-2024 budgets resulted in a 3- 4.5 % increase from proposal to the final rule. After the 2024 ozone season, no further adjustments would be required for the purposes of this rule.

The new requirements for the 12 states to make further emission reductions will take effect 60 days after publication of the notice of final rulemaking in the Federal Register. This date is expected to fall before a July 20, 2021 attainment date for the 2008 ozone NAAQS.

“This will enable improvements in downwind ozone and associated public health benefits by the 2021 ozone season,” EPA said.

The final rule establishes a new Group 3 trading program starting May 1, 2021 (the first day of the 2021 ozone season), EPA said it is issuing supplemental allowances to ensure that the increased stringency reflected in the new emission budgets will not take effect before the rule’s effective date.

The amount of supplemental allowances issued for each state reflects the difference between the state’s budgets under the Group 2 trading program and the new Group 3 trading program for the portion of the 2021 ozone season between May 1 and the rule’s effective date.

“It is important to note that this action is taken only with respect to good neighbor obligations under the 2008 ozone NAAQS, not the more stringent 2015 ozone NAAQS,” EPA said. “Nonetheless, emission reductions and associated improvements in air quality achieved in this action are beneficial towards attaining the 2015 ozone NAAQS.”

In addition, EPA is including a “safety valve” to provide further compliance flexibility. The safety valve will allow Group 3 sources to access additional Group 3 allowances by converting banked Group 2 allowances that remain after creation of the initial bank.

Additional information is available here.

Salt River Project offers home builders incentives for EV-ready homes

March 15, 2021

by Ethan Howland

APPA News

March 15, 2021

Salt River Project (SRP) is offering an incentive for home builders to install electrical vehicle chargers in new homes.

The move by SRP, based in Tempe, Arizona, comes as utilities are preparing for an expected surge in EV ownership. There will likely be at least 19 million EVs on U.S. roads by the end of this decade, Morgan Stanley analysts said in a report earlier this month.

SRP, which has about 1.1 million electric customers, expects to have about 100,000 homes with EVs in its service territory in the next two years, according to Rebecca Smout, SRP program manager for Energy Star Homes.

“This is the wave of the future,” Smout said.

SRP on March 1 started offering home builders that participate in the utility’s Energy Star Homes program a $300 incentive for installing Level 2 chargers in their new homes. The incentive builds on a $200 incentive SRP started offering last year.

Builders took advantage of the $200 incentive, but SRP wanted to see it used more, according to Smout.

“We’re getting pretty excited because we have a lot of interest now and we’re seeing communities that have changed,” Smout said.

The builders of four ongoing communities decided to become 100 percent EV ready, she said.

The builders of a large master community in Glendale, Arizona — Pulte Homes, Taylor Morrison and Lennar Homes — committed to building all the homes to be EV-ready, according to Smout.

Being an early adopter by building EV-ready homes gives homebuilders a way to differentiate themselves, she said.

The incentive for building EV-ready homes covers about half the typical cost of setting up a residential EV charger. Adding a charger to an existing home can be significantly more expensive than including it during the home’s original construction, Smout said.

SRP has used the results of annual surveys it takes of customers who have EVs to craft the incentive. The utility found that among more than 1,200 EV drivers, 70 percent have Level 2 chargers at home.

Level 2 chargers, which use a 240-volt power source, can charge a battery far more quickly than a Level 1 charger. They also support the most advanced charging technology available, including smart chargers and Amazon Alexa-enabled charging, according to SRP.

SRP’s most recent survey found that 84 percent of respondents in its service territory would recommend buying an EV to others and 40 percent said charging costs were lower or much lower than expected.

As part of its sustainability goals, SRP plans to support 500,000 EVs in its service territory and manage 90 percent of EV charging through price plans, dispatchable load management, original equipment manufacturer integration, connected smart homes, behavioral and other emerging programs.

Smout said the incentive fits into SRP’s Energy Star Homes program, which offers incentives to homebuilders that build highly efficient homes. Homes in the program can use up to half the energy and 20 percent less water than typical new homes built to meet current codes.

About 60 percent of the homes being built in SRP’s service territory across the greater Phoenix area are built under the program, Smout said.

SRP is meeting with homebuilders later this month to help them understand the requirements for installing EV chargers in their homes, according to Smout.

The utility is also preparing marketing material homebuilders can use to showcase the EV chargers in their homes, she said.

Tracey LeBeau named as interim administrator and CEO of WAPA

March 15, 2021

by Paul Ciampoli

APPA News Director

March 15, 2021

The U.S. Department of Energy (DOE) on Marc 12 named Tracey LeBeau as interim Administrator and CEO of the Western Area Power Administration (WAPA). LeBeau succeeds Mark Gabriel, who is departing after eight years as WAPA Administrator and CEO.

LeBeau most recently served as WAPA’s Senior Vice President and officially starts as interim Administrator and CEO on March 15.

LeBeau brings more than 20 years of executive experience in management, clean energy and infrastructure development, public-private partnerships, utility business operations, and federal program leadership and policy.

The DOE will now undertake a recruitment and selection process for a permanent WAPA Administrator and CEO.

Brighton, Colo.-based cooperative United Power’s Board of Directors recently named Gabriel as President and CEO of the organization effective March 15, 2021.

New $1.9 trillion COVID relief plan includes additional $4.5 billion for LIHEAP

March 15, 2021

by Paul Ciampoli

APPA News Director

March 15, 2021

The American Rescue Plan Act of 2021 signed into law by President Biden on March 11 includes a number of provisions of importance to public power utilities including an additional $4.5 billion in funding for the Low Income Home Energy Assistance Program (LIHEAP).

Overall, the act provides roughly $1.9 trillion in direct aid to individuals, state and local governments, and businesses.

Emergency rental assistance

An additional $21.55 billion will be added to the $25 billion appropriated for the Emergency Rental Assistance Program created under the Consolidated Appropriations Ac of 2021. Under this program, states, counties, and cities can establish programs to help renting households with rent and utility payments.

Eligibility requirements for the additional funding are the same as for the original bill. As such, grantees must prioritize households below 50 percent of the area median income, or where one or more members of the household has been unemployed for 90 days or longer. Grantees have flexibility to devise additional eligibility criteria. However, of that $21.55 billion, $2.5 billion is allocated for high-need grantees.

An “eligible household” is defined as a renter household that meets the following criteria:

- Qualifies for unemployment or has experienced a reduction in household income, incurred significant costs, or experienced a financial hardship related to COVID-19;

- Demonstrates a risk of experiencing homelessness or housing instability; and

- Has a household income at or below 80 percent of the area median.

In determining a household’s income for purposes of this provision, grantees should consider either the household’s total income for calendar year 2020 or the household’s monthly income at the time of application for assistance. For household incomes determined using the latter method, grantees must re-determine income eligibility every three months. A household receiving other forms of federal housing assistance are not eligible to receive assistance under this section of the act.

Initial funding for this program was released by the Treasury Department in January but is on holding pending further guidance from Treasury. The initial $25 billion allocation is available through December 31, 2021. ARP funds are available through September 30, 2027.

For additional information, click here.

Homeowner Assistance Fund

The bill will allocate $9.961 billion to create a new Homeowners Assistance Fund. These funds can be used to help homeowners with mortgage payments and utility bills.

Funds will be allocated to states based on unemployment and the total number or mortgagors with mortgage payments that are more than 30 days past due, or mortgages in foreclosure.

Eligibility requirements for the program are different than for LIHEAP or the Emergency Rental Assistance Program.

Specifically, at least 60 percent of funding must go to homeowners having incomes equal to or less than 100 percent of the area median income for their household size or equal to or less than 100 percent of the median income for the United States. Relief is limited to owner-occupied households and each state will determine how much can go towards utility bills.

Funds will be administered by the Treasury Department and are available for use through September 30, 2025.

Extension of emergency unemployment relief

This section extends a Coronavirus Aid, Relief, and Economic Security Act provision that provides a 50 percent subsidy for costs incurred by governmental employers who provide unemployment benefits on a reimbursable basis, rather than via tax contributions. It also increases the subsidy to 75 percent beginning after March 31. The subsidy will remain available through September 6, 2021 at the 75 percent rate.

Payroll credits

In addition, the new law provides an extension and expansion of the paid sick and emergency family leave tax credits created in the Families First Coronavirus Response Act of 2020.

Because the requirement to provide such leave has expired, the bill is providing payroll tax credits for employers who voluntarily provide paid leave through the end of September 2021.

It also expands eligibility to state and local governments that provide this benefit. Because of the parliamentary constraints of budget reconciliation legislation, however, credits to employers will only be available prospectively from March 31, 2021, through September 30, 2021.

Additionally, in contrast to payroll tax credits authorized in 2020, which were authorized as a credit against Old-Age, Survivors, and Disability Insurance (OASDI) taxes, this credit will be against Hospital Insurance (HI) taxes.

Additionally, the bill increases the amount of wages for which an employer may claim the paid family credit in a year from $10,000 to $12,000 per employee. Paid sick time and paid family leave credits could be claimed for leave taken to obtain a COVID-19 vaccine or to recover from an injury, disability, illness, or condition related to a COVID-19 immunization.

Coronavirus state and local fiscal recovery funds

The bill provides an additional $350 billion in addition to the $150 billion appropriated for the Coronavirus Relief Fund in the CARES Act. This $350 billion is split into two buckets: (1) $219.8 billion will be appropriated to the Coronavirus State Fiscal Recovery Fund, and (2) $130.2 billion will be appropriated to the Coronavirus Local Fiscal Recovery Fund.

With respect to the coronavirus state fiscal recovery fund, $195.3 billion will be allocated to the 50 states and D.C, mostly allocated based on share of unemployed individuals in the last quarter of 2020 with a minimum of $500 million allocation per state.

Another $4.5 billion will be allocated to the U.S. territories of the Commonwealth of Puerto Rico, the U.S. Virgin Islands, Guam, the Commonwealth of the Northern Mariana Islands, and American Samoa and $20 billion will be allocated to tribal governments.

To receive the funds, a state, territory, or tribal government must provide the Secretary of the Treasury a certification specifying that the government requires the federal assistance to effectively carry out pandemic response and mitigation activities consistent with the requirements of the permitted uses of the funds.

The Secretary of the Treasury will be required to make payments within 60 days of receiving a state, territory, or tribal government’s certification.

Recipient governments can use funds only to:

- Respond to or mitigate the COVID-19 emergency or its negative economic impacts;

- Cover costs incurred as a result of the emergency; Replace revenue lost, delayed, or decreased as a result of the emergency, as determined based on revenue projections as of January 27, 2020; or

- Address the negative economic impacts of the emergency.

Recipient governments will be permitted to transfer funds to special-purpose units of state or local government.

With respect to the coronavirus local fiscal recovery fund, $45.57 billion will be allocated for metropolitan cities, distributed pursuant to the formula used to administer the Community Development Block Grant (CDBG), modified to replace “all metropolitan cities” with “all metropolitan areas.”

A total of $19.53 billion will be reserved for non-entitlement units of local government, generally defined as those with fewer than 50,000 inhabitants. The Secretary of the Treasury will be required to transmit payments to states within 60 days of enactment, and states will be required to transmit payments to non-entitlement units of local government within 30 days of receipt. This provision will ensure that non-entitlement units of local government receive payments under this act as expeditiously as practicable.

States will have no discretionary authority to change the amount of, or attach additional requirements to, such payments. Payments will be distributed by the state to non-entitlement units of local government based on proportionate population, but not to exceed 75 percent of the most recent budget for the non-entitlement unit of government as of January 27, 2020. Of any amount above this cap, half will be retained by the state and half will be reallocated to other non-entitlement units of local government in the state.

A total of $65.1 billion will be allocated to make payments directly to counties of the 50 states, D.C., and the territories, distributed proportionate to population based on the most recent data available from the Census Bureau.

If such data is not available, the state may base distribution on other data as appropriate. The Secretary of the Treasury must make payments within 30 days of receiving a county’s certification.

Urban counties will receive at least the amount they will receive if the sum were distributed to metropolitan cities and urban counties according to the CDBG formula.

Funds for counties that are not units of general local government will be paid to the state to be distributed to cities proportionate to population. D.C. will be considered a single county that is a unit of general local government.

To receive the funds, a local government county or metropolitan city must provide the Secretary of the Treasury a certification specifying that the government requires the federal assistance to effectively carry out pandemic response and mitigation activities consistent with the requirements of the permitted uses of the funds.

Recipient governments will be permitted to use funds only to respond to or mitigate the COVID-19 emergency or its negative economic impacts; to cover costs incurred as a result of the emergency, to replace revenue lost, delayed, or decreased as a result of the emergency, as determined based on revenue projections as of January 27, 2020 or to address the negative economic impacts of the emergency.

Recipient governments will be permitted to transfer funds to special-purpose units of state or local government.

Western EIM governing body adopts initiatives for summer reliability

March 13, 2021

by Paul Ciampoli

APPA News Director

March 13, 2021

The Western Energy Imbalance Market (EIM) governing body on March 10 unanimously approved market and operational enhancements for Western EIM entities participating in the California Independent System Operator’s (CAISO) real-time energy market.

The enhancements are intended to help maintain grid reliability this summer.

CAISO said the governing body’s decision will improve the resource sufficiency evaluation to ensure each balancing authority area participates in the Western EIM with the necessary resources and enhance real-time energy market models to provide better operational coordination among balancing authority areas in the Western EIM.

These items will be on the ISO Board of Governors’ next meeting agenda.

Additionally, the Western EIM Governing Body provided, in its advisory capacity, support for a market-pricing enhancement for contingency reserves that will strengthen incentives during tight supply conditions.

This item requires the approval of the ISO Board of Governors, which is scheduled to consider it and other Market Enhancements for Summer 2021 Readiness initiatives later this month.

The Western EIM governing body’s action is the first of several improvements identified by the ISO to be better prepared for summer following the extreme heat event that enveloped California and the West in August 2020.

The final root cause analysis published in January 2021 found that extreme heat, resource adequacy deficiencies, and planning and market processes that were not designed to fully address an extreme heat storm contributed to rotating outages for two days in August 2020.

CAISO President and CEO Elliot Mainzer discussed the grid operator’s plans for this summer in a recent APPA Public Power Now podcast episode.

The Western EIM governing body oversees the Western EIM, an energy market comprised of 11 balancing authorities in eight states.

By 2023, 22 active Western EIM participants will represent over 83 percent of load within the Western Electricity Coordinating Council footprint.

NYPA reports significant progress made in first year of statewide energy efficiency program

March 13, 2021

by Paul Ciampoli

APPA News Director

March 13, 2021

The New York Power Authority (NYPA) on March 8 reported that it has made significant progress during the first year of BuildSmart2025, a statewide energy efficiency program aimed at drastically reducing energy usage in state facilities.

The energy saving program calls for a reduction in site energy use in state buildings by 11 trillion British Thermal Units (BTUs) by the end of 2025.

As of the end of 2020, state entities have implemented or are actively developing energy projects with calculated energy savings of more than 4 trillion BTUs with the expectation that they will reduce an additional 1 trillion BTUs by the end of 2021, NYPA said.

There are 68 state entities participating in the BuildSmart 2025 program, with an assigned cumulative goal of reducing energy use in state facilities by 11 trillion BTUs. The goal is equivalent to a 34% reduction in energy use from a baseline year of 2015.

The program goal directly supports Governor Andrew Cuomo’s Climate Leadership and Community Protection Act, which calls for a reduction in energy use statewide by 185 trillion BTUs.

Additionally, the program supports the work of the GreenNY Council, which helps state agencies implement the state’s lead-by-example directives.

NYPA noted that BuildSmart2025 builds on the success of BuildSmartNY, which was launched in 2012 and directed state agencies to reduce their source energy use intensity 20 percent by 2020.

Including committed projects, the state exceeded that goal, recording a combined source energy use intensity reduction of 22.6 percent.

NYPA financed more than $650 million in energy efficiency projects at state buildings under BuildSmartNY and NYPA currently has plans to invest more than $850 million in energy efficiency projects at state buildings over the next several years as part of BuildSmart2025.

NYPA offers a wide variety of energy technology and renewable energy services to its governmental customers under BuildSmart2025, including energy audits, project engineering, design, installation, and construction management.

The energy efficiency projects carried out by NYPA include high efficiency lighting retrofits, occupancy and daylighting lighting sensors, building and energy management systems, boilers, chillers, air-handling systems, thermal storage, microgrids, solar photovoltaic systems, digester gas systems, and emerging energy technologies. NYPA provides financing with full cost recovery by its customers.

Some of NYPA’s state customers include the State University of New York, City University of New York, Metropolitan Transportation Authority, Office of General Services, Office of Mental Health and Department of Corrections and Community Supervision.

Some major energy efficiency projects already completed under the program include more than $23 million for a new chiller plant and cooling towers at Grand Central Terminal, nearly $24 million in comprehensive air-handling improvements at the State University of New York at Stony Brook Life and Science building, and nearly $18 million in boiler and chiller plant upgrades at W. Averell Harriman State Office Building Campus.

NYPA’s NY Energy Manager directly supports BuildSmart2025 by providing energy-use monitoring and suggestions to customers for improvements.

Through the NY Energy Manager service, NYPA tracks hundreds of energy efficiency projects implemented by state agencies and benchmarks their performance into the future.

Over the last 20 years, the NYPA Board of Trustees has approved nearly $4 billion in investments on energy efficiency projects with state and local government customers around the state, supporting hundreds of energy-saving projects.

Public power representatives invited to apply for community solar working group

March 13, 2021

by Paul Ciampoli

APPA News Director

March 13, 2021

Public power representatives and collaborators in need of expertise or a community of practice around community solar projects are being invited to apply for an expert-led municipal utility community solar working group.

Guided by Department of Energy and National Renewable Energy staff expertise as part of the National Community Solar Partnership (NCSP), a selected group of representatives from the public power community will work in parallel to scope community solar projects for their jurisdictions.

By the end of the nine- to ten-month working group, each participating utility will have developed a business case for an exploratory project or for a site-specific project.

Working session topics will include:

- Defining community solar project goals and objectives for utilities and jurisdictions

- Market potential/customer appetite

- Program designs and subscription models

- Identifying potential sites and calculating PV potential

- Project economics and financials

- Developing a project proforma

- Project construction, RFPs, timelines

- Customer acquisition, program implementation and marketing

- Documenting the project opportunity and finalizing the project proposal package

In order to get the most value out of the working group, participants will be asked to commit to spending approximately 3-5 hours per month preparing for and engaging in working sessions, taking advantage of networking opportunities and discussing community solar options and priorities with others in their respective organizations.

At a minimum, participants will be expected to:

- Send at least one representative who is engaged with the effort to each working session. Meetings will be approximately 90 minutes in length and occur monthly through the end of 2021.

- Take an active role in discussions, having completed preparatory work assigned before each meeting (data-gathering tasks, brainstorming, understanding internal priorities, etc.)

- Take advantage of opportunities to network with peers and schedule 1:1 calls with subject matter experts between working sessions, as needed.

For those interested in applying for the working group, complete and interest form here. Interest forms must be submitted by March 19.

Douglas County PUD Commissioners break ground on renewable hydrogen facility

March 13, 2021

by Paul Ciampoli

APPA News Director

March 13, 2021

Douglas County PUD Commissioners Aaron Viebrock, Molly Simpson and Ronald E Skagen recently moved the first shovels of dirt at the soon to be built renewable hydrogen production facility near Baker Flats, East Wenatchee.

The 5-megawatt pilot project will provide flexibility to Washington State-based Douglas PUD operations at their Wells Hydroelectric Project.

Generation requests can be sent to the hydrogen electrolyzer to reduce the mechanical adjustments necessary at the Wells Hydroelectric Project to balance the grid, Douglas PUD noted. This will reduce the maintenance necessary on the turbine units and associated equipment.

This project has been in the works for several years with the first hurdle cleared with the passage of S.B. 5588 in 2019 authorizing PUDs to produce and sell renewable hydrogen and a $250,000 planning grant.

Site excavation started this month with anticipated delivery of the electrolyzer in July.

Connections of piping, electrical and water will follow with production of renewable hydrogen starting late this year.

Click here for a video of the groundbreaking event.

APPA opposes FEMA proposed disaster threshold

March 12, 2021

by Paul Ciampoli

APPA News Director

March 12, 2021

The American Public Power Association (APPA) recently voiced opposition to a Federal Emergency Management Agency (FEMA) disaster threshold Notice of Proposed Rulemaking (NOPR).

“Every year, public power utilities experience some degree of infrastructure damage due to events, such as ice storms, wildfires, tornadoes, floods, hurricanes, and earthquakes,” APPA said. “If this damage is severe enough to be declared a disaster by the President of the United States, recovery costs are eligible for reimbursement through grants from FEMA,” APPA said in its Feb. 12 comments submitted to FEMA.

These grants “can amount to millions of dollars and are critical to the ability of public power utilities to recover from disasters, making FEMA’s proposed changes an economically significant regulatory action of critical importance to APPA and its members.”

When determining whether to recommend the President declare a major disaster authorizing the public assistance program, FEMA proposes in the NOPR to raise the baseline per capita indicator (PCI) and to further adjust the PCI on a state-by-state basis depending on each state’s total taxable resources (TTR).

Specifically, it would adjust the PCI to reflect the failure to inflation adjust the PCI from 1986 to 1999 and further modify the PCI by multiplying it by the index of each state’s hypothetical TTR as estimated by the U.S. Department of Treasury.

While APPA supports FEMA’s goals to reduce the number of disasters to which it must respond and to see states and localities increase their ability to mitigate against, respond to, and recover from disasters, it opposes the NOPR as proposed because the bulk of the financial effects of the change would be borne largely by a handful of states.

In addition, the new thresholds “would abruptly and dramatically shift the number and size of disasters for which some states must prepare, while doing little to reduce the number of declared disasters in states with the highest incidence of disaster declarations,” APPA pointed out.

The NOPR taken as a whole “would simply shift the responsibility of disaster recovery from the federal government to states and localities when other existing federal policies are serving to make taking those responsibilities more costly.”

Moreover, the NOPR fails to take into consideration an admonition from Congress that FEMA should give greater consideration to severe local impact or recent multiple disasters, APPA said.

If FEMA intends to proceed with the NOPR, “we would strongly urge phasing it in over time to allow states to develop the operational and financial resources to fill in the gap left by the proposal,” APPA said.

Second, federal tax policy was amended in 2017 with the specific intention of making it more costly for state and local governments to raise taxes and refinance existing debt, the trade group noted.

FEMA should amend the NOPR to reflect the fact that the value of is reduced by the federal taxes imposed on state and local taxes on that TTR, APPA argued.

“Finally, FEMA must be mindful that states with greater resources also likely have proportionately greater responsibilities, taxing their ability to respond when smaller entities are adversely affected by events. APPA believes FEMA could address this issue by responding to Congress’ direction in the DRRA to give greater consideration to severe local impact or recent multiple disasters.”

Painesville Electric helps student with unique light project

March 10, 2021

by Paul Ciampoli

APPA News Director

March 10, 2021

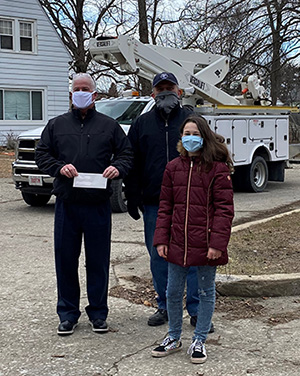

When she was in fifth grade, Painesville, Ohio’s Addison Nance started researching light pollution in a science fair project.

That research sparked her interest in changing a streetlight near her house. Nance’s persistence and hard work, along with assistance from public power utility Painesville Electric, resulted in the installation of a new LED light earlier this month.

Jeff McHugh, electric superintendent in the electric division of the City of Painesville, noted that Nance was working on a science project for her school and approached the city manager at the time, Monica Dupee, about doing something with her streetlight.

Dupee encouraged Nance and gave her some direction and McHugh’s contact information. Dupee told Nance that she needed to get her neighbors to agree, find some funding to help pay for the light, and do a presentation before the city council for their approval.

On Nov. 18, 2019, Nance gave a presentation to the Painesville City Council on light pollution and the effects on plants, animals and the atmosphere. She provided alternatives for the light post on her street in the City of Painesville.

The city council was impressed by her research and activism. Dupee and the council decided they would move forward with the project if Nance was able to secure signatures from her neighbors in favor of the new light and raise the $300 to pay for it.

Painesville Municipal Electric would install it for free and it would be supported by the city’s electric system.

A little under a year later, Nance had the necessary signatures and the $300 and the city purchased the specialty light for her street.

Painesville Municipal Electric installed the new light on March 3, 2021 and there was a small ceremony for Nance and her family on March 4.

What makes this particular light special is that it is an LED light and is engineered to direct the light down and not to the sides.

To view the city council video of Nance’s presentation, go to https://www.youtube.com/watch?v=Jwi9JTgscoE and visit the 2:20 mark.