Calif. CCAs Issue First Ever Clean Energy Bonds Valued At More Than $2 Billion

December 6, 2021

by Paul Ciampoli

APPA News Director

December 6, 2021

Three California community choice aggregators (CCAs) have issued California’s first ever municipal non-recourse Clean Energy Project Revenue Bonds through the California Community Choice Financing Authority (CCCFA). The two separate bond issuances are valued at over $2 billion for thirty-year terms.

The three CCAs are East Bay Community Energy, Marin Clean Energy (MCE) and Silicon Valley Clean Energy. The two Clean Energy Project Revenue Bonds will prepay for the purchase of over 450 megawatts of renewable energy.

These transactions will reduce renewable power costs by almost $7 million annually for the first 5-10 years, according to the CCAs.

They noted that a Clean Energy Project Revenue Bond is a form of wholesale electricity prepayment that requires three key parties: a tax-exempt public electricity supplier (the CCA), a taxable energy supplier, and a municipal bond issuer.

The CCAs enter into long-term power supply agreements for clean electricity sources like solar, wind, geothermal, and hydropower.

The municipal bond issuer — in this case, CCCFA — issues tax-exempt bonds to fund a prepayment of energy that is to be delivered over 30 years. The energy supplier utilizes the bond funds and provides a discount to the CCA on the power purchases based on the difference between the taxable and tax-exempt rates. This discount is historically in the range of 8-12%, and minimum discounts are negotiated for each transaction.

The first of these bonds, which was issued by CCCFA for the benefit of East Bay Community Energy and Silicon Valley Clean Energy, was underwritten by Morgan Stanley. It successfully generated nearly $1.5 billion in proceeds, after having received an investment grade “A1” rating from Moody’s Investors Service and a “Green Climate Bond” designation from Kestrel Verifiers, making it the largest ever issuance of prepayment bonds for clean electricity.

The second transaction, issued by CCCFA for the benefit of MCE, was underwritten by Goldman Sachs. The bond sale produced approximately $700 million in bond proceeds. The issue received an investment grade “A2” rating from Moody’s and a “Green Climate Bond” designation from Kestrel Verifiers.

CCCFA was established in 2021 with the goal of reducing the cost of power purchases for member CCAs through pre-payment structures. The founding members of CCCFA include Central Coast Community Energy, East Bay Community Energy (EBCE), MCE, and Silicon Valley Clean Energy.

EBCE is a not-for-profit public agency that operates a community choice energy program for Alameda County and fourteen incorporated cities, serving more than 1.7 million residential and commercial customers.

MCE provides electricity service and programs to more than 540,000 customer accounts and more than one million residents and businesses in 37 member communities across four Bay Area counties: Contra Costa, Marin, Napa, and Solano.

Silicon Valley Clean Energy provides electricity from renewable and carbon-free sources to more than 270,000 residential and commercial customers in 13 Santa Clara County jurisdictions.

The American Public Power Association has initiated a new category of membership for community choice aggregation programs.

Phillips Sworn In As FERC Commissioner

December 4, 2021

by Paul Ciampoli

APPA News Director

December 4, 2021

Willie Phillips on Dec. 3 was sworn in as a member of the Federal Energy Regulatory Commission (FERC) for a five-year term that ends June 30, 2026.

Phillips was nominated to FERC by President Biden in September 2021 and confirmed by the Senate on November 16, 2021.

Phillips, a Democrat, returns FERC to its full complement of five commissioners, and he provides the Democrats with a 3-2 majority.

Before joining FERC, Phillips was the Chairman of the District of Columbia Public Service Commission. He previously worked as Assistant General Counsel for the North American Electric Reliability Corporation (NERC), and also worked for two law firms.

New River Light and Power Green Power Program Nominated for Cleantech Innovation Award

December 1, 2021

by Vanessa Nikolic

APPA News

December 1, 2021

North Carolina public power utility New River Light and Power’s (NRLP) Green Power Program has been nominated for a 2021 Cleantech Innovation Award from the Research Triangle Cleantech Cluster (RTCC).

RTCC is an initiative of business, government, and nonprofit leaders focused on advancing the growth of the regional and statewide clean technology (cleantech) economy.

With its Third Annual Cleantech Innovation Awards, RTCC aims to recognize the contributions of the companies, organizations, and individuals that have advanced cleantech solutions across North Carolina. The awards are judged by leaders from the cleantech industry and public sectors.

NRLP’s Green Power Program is nominated under the Cleantech Impact: Energy category which recognizes an energy project that applies cleantech to create positive impacts for the environment, economy, and residents. Projects may include innovations to existing grid infrastructure to enhance resiliency, renewable energy installations, microgrid deployments, or innovative energy efficiency programs.

The Green Power Program provides residential and commercial customers with the opportunity to purchase clean energy. NRLP customers can choose to purchase blocks of hydroelectric power to offset their monthly carbon-based electric use. Each block costs $5 and represents 250 kilowatt-hours (kWh) of clean energy.

NRLP launched the program and made it available to customers at the beginning of August 2021. Prior to its launch, plans to offer the program were in the works for a number of years as customers became more interested in renewable energy.

The utility conducts customer surveys every three years through ElectriCities of North Carolina. NRLP’s 2020 customer survey found that 65% of its residential customers indicated they would be willing to pay an additional $5 on their monthly bill to obtain 30% of their electricity from renewable sources.

NRLP public communications specialist Chris Nault said the nomination recognizes and supports the utility’s commitments to providing clean energy and outstanding service to its customers and the community.

“This nomination for a 2021 Cleantech Innovation Award is an honor for NRLP and App State,” Nault said. “It is great to know that our hard work and service to our customers is being recognized by an organization like the Research Triangle Cleantech Cluster.”

The winners in each category will be announced at an awards ceremony on Wednesday, December 8 in Raleigh, North Carolina.

For a complete list of nominees, visit https://www.researchtrianglecleantech.org/cleantechawards2021.

NRLP was previously nominated for a 2019 Cleantech Innovation Award for Grid Innovation related to the deployment of technology on its electric grid. Additional details on the 2019 nomination can be found here.

NRLP is an electric utility, owned by Appalachian State University, that serves nearly 9,000 residential and commercial customers in Boone, North Carolina and the surrounding community. The Green Power Program is made possible through NRLP’s new wholesale power agreement with Carolina Power Partners, effective January 2022.

The NRLP Green Power Program is a component of Appalachian State University’s commitment to reduce its use of fossil fuels and provide an option for NRLP customers to do the same.

Ditto Urges Senate To Retain Direct Pay Energy Tax Credit Provisions

December 1, 2021

by Paul Ciampoli

APPA News Director

December 1, 2021

The U.S. Senate should keep the provisions of the Build Back Better Act that will ensure that all electric utilities and their customers benefit from tax incentives encouraging investments to transition to cleaner energy technologies, investments that are needed to reduce greenhouse gas emissions, Joy Ditto, President and CEO of the American Public Power Association (APPA) said in a Nov. 30 letter to Sen. Ron Wyden, D-Ore.

“Similar to the direct pay provisions of your Clean Energy for America Act (S. 2118), enactment would mean that all utilities, not just for-profit utilities, can directly benefit from these energy tax credits,” wrote Ditto in her letter. “This will make these incentives fairer and more effective.”

Wyden is Chairman of the Senate Committee on Finance.

Ditto noted that federal tax expenditures are the primary tools that Congress uses to incentivize energy-related investments.

However, tax-exempt entities– including public power utilities, rural electric cooperatives, and other not-for-profit entities — cannot directly claim such incentives.

“In effect, not-for-profit utilities serving nearly 30 percent of utility customers in the U.S. are effectively locked out of owning facilities being incentivized by such credits – wind, solar, energy storage, etc. This explains why 80 percent of the nation’s (non-hydropower) renewable energy generating capacity is owned by merchant, for-profit, generators,” Ditto said.

The Build Back Better Act (H.R. 5376) addresses this inequity by allowing the direct payment of energy tax credits – including production, investment, and carbon capture tax credits – to any entity that owns the project, she went on to say in the letter.

“This would remove the financial disincentive for public power utilities to own such facilities, which are needed to transition to cleaner energy technologies needed to address climate change. It would also allow the full value of these credits to pay for additional clean energy investments that will benefit the more than 90 million Americans nationwide served by tax-exempt, not-for-profit electric utilities,” wrote Ditto.

“We strongly encourage Congress to take the steps needed to make these tax credits both more effective and more equitable for public power utilities and the communities they serve.”

The House passed the Build Back Better Act in November, sending it to the Senate for consideration. Senate Majority Leader Charles Schumer, D-N.Y., has indicated that he would like the Senate to take up the reconciliation bill in December.

Planning Is Underway For Project That Will Bring Power To Navajo Nation Residents

November 30, 2021

by Paul Ciampoli

APPA News Director

November 30, 2021

Planning for Light Up Navajo III, which will connect Navajo Nation families to the power grid, is underway. Public power utilities are encouraged to consider participating in Light Up Navajo III, which will start in the spring of next year.

The American Public Power Association (APPA) is working with the Navajo Tribal Utility Authority (NTUA) to help volunteers continue to bring electricity to families in need.

Light Up Navajo III is scheduled to take place from April through June of 2022.

“This project has become a godsend for so many families that are waiting for the day to be able to store fresh food in a refrigerator, to be able to turn on the lights when the sun goes down and the young ones can do their homework without using a flashlight,” said NTUA General Manager Walter Haase. “It is our hope that our sister APPA companies will send their crews to help bring positive change. For every family we connect, there is another one waiting.”

In 2019, NTUA partnered with APPA to create an innovative, pioneer project called Light Up Navajo. The goal was to connect Navajo homes to the electric grid. There were 138 visiting line workers who traveled to Navajo Nation for the six-week pilot project. Electricity was extended to 233 regional families. The success of the pilot project paved a path for future Light Up Navajo projects.

In August 2019, NTUA officials said there would be another year of “Light Up Navajo” based on the outcome of the pilot project. NTUA was preparing for Light Up Navajo II for spring 2020. However, citing growing uncertainty tied to the COVID-19 pandemic, NTUA ipostponed the Light Up Navajo II project in 2020.

In an August 2021 episode of APPA’s Public Power Now podcast, Delaware Municipal Electric Corporation’s Kimberly Schlichting, Gary Johnston of the Lewes Board of Public Works in Delaware, and Joshua Little of the Town of Smyrna, Delaware, discussed the Light Up Navajo project.

Interested public power utilities should contact lightup-navajoproject@ntua.com for more information on this important event.

Wells Fargo, D.E. Shaw Close Tax Equity Deal For Solar-Storage Project

November 30, 2021

by Peter Maloney

APPA News

November 30, 2021

Units of Wells Fargo and D.E. Shaw this week closed on a tax equity financing for a solar-plus-storage project in McKinley County, N.M.

The Arroyo Solar and Storage project is a 300-megawatt (MW) solar array combined with a 150 MW, 600-megawatt hour (MWh) battery energy storage system that was originally developed by Centaurus Renewable Energy.

Centaurus closed on a $70 million construction bridge loan for the project from Voya Investment Management in late June. D. E. Shaw Renewable Investments (DESRI) acquired the project from Centaurus in September.

The first phase of the Arroyo project is expected to begin commercial operation in June 2022 with full operation expected in the fall of 2022.

Arroyo is currently under construction with efforts being made to hire workers locally and from the Navajo Nation. The project is expected to generate as many as 250 jobs during construction.

D. E. Shaw and Wells Fargo’s Renewable Energy & Environmental Finance group have now closed on the long-term tax equity financing for the project. The value of the deal was not disclosed.

A tax equity financing usually involves a financial entity taking an equity stake in the project company in return for revenue streams and tax credits generated by the project.

At the end of a period of time, the tax equity investment in the project usually reverts or is bought back by the original developer or the project sponsor.

For the Arroyo project, Wells Fargo is the tax equity investor, spokeswoman Trina Shepherd said via email. D.E. Shaw provided the cash equity and is the project sponsor and has an option to buy out the tax equity investor at the end of the deal.

Solar-plus-storage projects are eligible for investment tax credits (ITC) for both the solar and storage portions of a project, if certain criteria are met. The ITC percentage for projects beginning construction in 2021 or 2022 is 26 percent of the value of the project.

The Arroyo project is Wells Fargo’s first tax equity investment in a project with co-located battery storage. It is D.E. Shaw’s first solar project with co-located battery storage to enter construction and financing.

The Arroyo project has two offtake contracts with Public Service Company of New Mexico, one for the solar output and one for the output from the storage system. The combined output of the project will supply a portion of the replacement capacity needed to retire the 847-MW San Juan coal plant in San Juan County, N.M., which is scheduled to retire at the end of 2022.

Sundt Construction is building the Arroyo solar facility. ECI of Billings, Mont., provided the design for the substation and switchyard that will be built by its EPC Services subsidiary. Tesla will supply and commission its Megapack battery units for the facility, and New Mexico-based Affordable Solar Installation will construct the battery energy storage system. SOLV Energy and Tesla will provide ongoing operations and maintenance services to the facility once it is in operation.

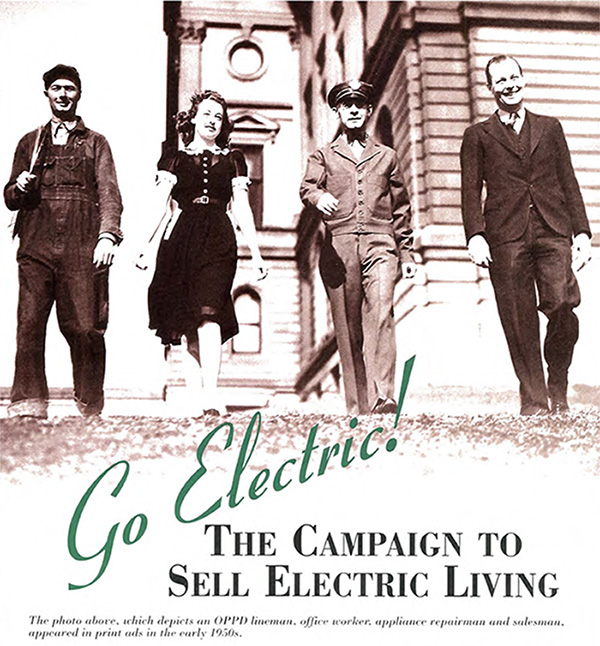

Nebraska’s Omaha Public Power District Celebrates 75th Anniversary

November 30, 2021

by Paul Ciampoli

APPA News Director

November 30, 2021

Nebraska public power utility Omaha Public Power District (OPPD) on Dec. 2 will celebrate the 75th anniversary of its creation.

“OPPD has powered the communities it serves through wars, floods and pandemics,” OPPD’s newsletter, The Wire, notes in an article about the anniversary.

The history of OPPD dates back to 1917, when the Nebraska Power Company was incorporated. On June 1 of the same year, the newly formed company acquired the property of the Omaha Electric Light and Power Company. In 1946, its customers numbered 83,507, gross revenues totaled $10,828,000, kilowatt-hour sales were 552,000,000 and generating capability had reached 119,000 kilowatts.

On Dec. 2, 1946, the state legislature created OPPD as a political subdivision of the state of Nebraska, which acquired the properties operated by the Nebraska Power Company.

In January 1965, the Eastern Nebraska Public Power District merged with OPPD, doubling the size of our service area to 5,000 square miles. With the merger, four counties were added to OPPD’s service area, which now covers all or part of 13 counties in southeastern Nebraska.

Click here for milestone and anniversary-related content posted on The Wire’s webpage.

A 75th anniversary video OPPD created for an employee celebration is posted here,

EPA And Department of Army Issue New Proposed WOTUS Definition

November 30, 2021

by APPA News

November 30, 2021

The U.S. Environmental Protection Agency (EPA) and the U.S. Department of the Army have proposed to reestablish the pre-2015 definition of “waters of the United States” (WOTUS).

The proposed rule is updated to reflect U.S. Supreme Court precedent, the agencies said.

The American Public Power Association (APPA) in September 2021 submitted comments in response to a request for recommendations to revise and refine the regulatory definition of WOTUS. In those comments, APPA advocated that a new definition must draw clear jurisdictional lines, provide needed predictability for the regulated community, and be consistent with the Clean Water Act and Supreme Court precedent.

In 2021, U.S. district courts in Arizona and New Mexico vacated the prior administrations Navigable Waters Protection Rule (NWPR). In light of the court actions, the agencies have been implementing the pre-2015 regulatory regime nationwide since early September 2021.

The agencies have indicated their intention to continue to consult with stakeholders to refine the definition of WOTUS in both implementation and future regulatory actions.

EPA and the Army are interpreting WOTUS to mean the waters defined by the longstanding 1986 regulations.

Therefore, in the proposed rule, the agencies interpret the term WOTUS to include:

- Traditional navigable waters, interstate waters, and the territorial seas, and their adjacent wetlands;

- Most impoundments of WOTUS;

- Tributaries to traditional navigable waters, interstate waters, the territorial seas, and impoundments that meet either the Army relatively permanent standard or the significant nexus standard; wetlands adjacent to impoundments and tributaries, that meet either the relatively permanent standard or the significant nexus standard; and

- “Other waters” that meet either the relatively permanent standard or the significant nexus standard.

The agencies interpret the significant nexus standard to mean “waters that either alone or in combination with similarly situated waters in the region, significantly affect the chemical, physical, or biological integrity of traditional navigable waters, interstate waters, or the territorial seas.”

Another amendment to the older regulations is to the term “relatively permanent standard,” which has been updated to mean waters that are “relatively permanent, standing, or continuously flowing and waters with a continuous surface connection to such waters.”

The proposal maintains the waste treatment system exclusion, returning to the 1986 regulatory version of that exclusion with ministerial changes made in the NWPR. The proposal would remove the favorable definition of waste treatment system that was codified in the NWPR.

For more information on the proposed rule and registering for the virtual public hearings, click here.

NERC Winter Report Says Extreme Cold Weather Could Cause Reliability Shortfalls

November 29, 2021

by APPA News

November 29, 2021

Certain regions of the country, particularly those vulnerable to extreme weather, natural gas supply disruptions and low hydro conditions, are at risk for electricity supply disruptions this winter, according to the North American Electric Reliability Corp. (NERC).

In its 2021–2022 Winter Reliability Assessment, NERC advises the industry to prepare by taking steps for generator readiness, fuel availability and sustained operations in extreme conditions.

Although anticipated reserve margins meet or surpass the NERC’s margin levels in all areas, the organization warned that “extreme or prolonged cold temperatures over a large area could create “unique challenges in maintaining grid reliability in many parts of North America.”

Responses NERC solicited from grid stakeholders indicate that they have taken preparations to enhance reliability during cold weather events, but “some plant vulnerabilities can be anticipated for the upcoming winter.”

To reduce the risk of shortfalls, NERC is recommending:

- Grid operators and generator operators review NERC’s Level 2 cold weather alert and take the recommended steps prior to winter;

- Grid operators should prepare their operating plans to manage potential supply shortfalls and take steps for generator readiness, fuel availability, and sustained operations in extreme conditions. And balancing authorities should poll their generating units in advance of approaching severe weather to assess their readiness for normal and extreme conditions;

- Balancing authorities and reliability coordinators should conduct drills on alert protocols, and balancing authorities and generator operators should verify protocols and operator training for communications and dispatch;

- Distribution providers and load-serving entities should review non-firm customer inventories and rolling black out procedures to ensure that no critical infrastructure loads such as natural gas or telecommunications would be affected and rehearse protocols that prepare customers for the impacts of severe weather.

“To be resilient in extreme weather, we are counting on our grid operators to proactively monitor the generation fleet, adjust operating plans and keep the lines of communication open,” Mark Olson, manager of reliability assessments at NERC, said in a statement.

NERC referenced last February’s cold weather that caused outages in Texas and other states, and said that peak demand or generator outages that exceed forecasts, such as have occurred in previous winters, “can be expected to cause energy emergencies” in the Midcontinent Independent System Operator (MISO), Southwest Power Pool (SPP), and Electric Reliability Council of Texas (ERCOT) regions.

While both New England and the Southwest have sufficient planning reserves, NERC warned that fuel supplies to generators in those areas can be vulnerable during cold weather conditions. NERC also highlighted New England and California for their vulnerability to weather related natural gas supply disruptions. Specifically, Southern California and the Southwest have limited natural gas storage and lack redundancy in supply infrastructure, so generators there also could face fuel supply curtailment or disruption from extreme winter weather.

In New England, the capacity of natural gas transportation infrastructure can be constrained when cold temperatures cause peak demand for both electricity generation and consumer space heating needs, exacerbating the risks for fuel-based generator outages and reductions, NERC noted.

In the Pacific Northwest, resources are sufficient but higher demand from extreme temperatures could cause shortfalls, particularly if the region’s drought continues and causes low hydro conditions, reducing electricity supply for transfer throughout the area, NERC warned.

MMWEC Taps APPA Grants To Study Emission Reduction Strategies, Undergrounding

November 29, 2021

by Peter Maloney

APPA News

November 29, 2021

Massachusetts Municipal Wholesale Electric Co. (MMWEC) has won Demonstration of Energy & Efficiency Development (DEED) grants totaling $148,248 from the American Public Power Association, one to help the joint action agency optimize its carbon dioxide (CO2) emission reduction strategies and the other to study the potential benefits of co-deploying undergrounding electric cables with optical fiber.

The more recent grant, for $25,050, aims to help MMWEC fulfill its mission to provide the most efficient, innovative and equitable path to greenhouse gas (GHG) emissions reductions for its member municipal light plant (MLP) communities.

For the grant, Incorporating Carbon as the Driver of MMWEC’s Energy Efficiency Program, MMWEC will work with the Center for EcoTechnology, which will conduct a study on how MMWEC and its member MLPs can assess the emissions reduction benefits of energy efficiency, building electrification, transportation electrification, renewable energy, demand response and energy storage. The study is expected to be completed in 2022.

“This project will undertake the critical steps necessary to develop the underlying assumptions, calculations and tools for quantifying carbon emissions associated with the evolving energy portfolios of MMWEC’s members, and the measures that MLPs incentivize,” Bill Bullock, sustainable energy policy and program senior manager at MMWEC, said in a statement.

The project aligns with commitments by MMWEC’s member MLPs to reach net zero carbon dioxide emissions in energy sales by 2050, in support of a Massachusetts strategy to reach net zero emissions by 2050.

But it is important to note that the value of this research will extend beyond Massachusetts to provide public power utilities across the country with valuable tools and knowledge to assist in making more informed, actionable steps towards a lower carbon future.

The first grant, for $123,198 was awarded in the spring and is being used to support Project Groundwork, a research initiative that will evaluate the potential benefits to public power utilities of deploying optical fiber broadband networks in combination with underground electric cabling to help bridge the digital divide.

MMWEC is working with the University of Massachusetts Amherst’s (UMass) Energy Transition Institute and Groundwork Data, a non-profit research initiative focused on public infrastructure, on the project.

“We’ve found that much of the existing research on undergrounding is concerned with the costs of trenching, and that there is little disagreement on the overall resiliency benefits,” Mike Bloomberg, head of Groundwork Data, said in a statement.

“We aim to pick up where these studies have left off by taking into account a greater number of costs and benefits associated with undergrounding. Cities are complex systems and there are dozens, if not hundreds, of other factors that must be taken into account with projects of this scale and importance.”

The wider strategies Project Groundwork is exploring include:

- Sharing utility infrastructure between electricity and broadband;

- Shifting underground utility infrastructure out of the road and into the public rights-of-way;

- Laying cable on existing surfaces and covering with cycling paths;

- Micro-trenching, horizontal drilling, and innovative wireless technologies to connect the network to individual homes and businesses.

“Project Groundwork is gathering and analyzing a substantial amount of infrastructure data relating to age, investment costs and synergies with other utility services such as broadband and water,” Christopher Roy, DEED director for region 8 and general manager of Shrewsbury Electric & Cable Operations, said via email.

The data generated by Project Groundwork should be applicable beyond MMWEC and its member utilities. “Having this information will allow more informed decision making with respect to not only electric system upgrades but also how to best support upgrades of other critical community infrastructure such as telecommunications and water, even if these are not currently services provided by the public power authority,” Roy said.

“My hope is that the results of Project Groundwork will reveal opportunities for legislative action supporting the creation of new public power entities,” Roy said. “Our business model has resulted in some of the most efficient and effective infrastructure investments that stretch each dollar to the fullest. This approach is what will enable the necessary infrastructure upgrades across the country to happen and serve as the foundation for technological advancements.”

MMWEC is a non-profit, public corporation that provides a variety of electric power supply, financial, risk management and other services to consumer-owned municipal utilities in Massachusetts.